In our latest Wired-In webinar, SEON’s CEO, Tamas Kadar, assessed the ripple effect of AI in payments, highlighting dynamic challenges and opportunities to achieve transformative change. … Read More

AML

The EU’s Anti-Money Laundering Authority (AMLA) – what is it and what could it mean for AML compliance?

In a bid to strengthen its defences against financial crime, the European Union has taken a significant stride with the establishment of the Anti-Money Laundering and Countering the Financing of Terrorism Authority or AMLA. As the “central authority coordinating national … Read More

AI tops the list of biggest threats to regulated firms this year

55 percent of regulated businesses surveyed see AI as their biggest threat this year Over half of regulated companies in the UK see the deployment of AI as their biggest threat this year, while the evolving regulatory landscape and economic … Read More

The role of tech in improving AML processes: overcoming 5 key challenges

At a time when AML regulations are evolving on a near weekly basis, the importance of ensuring complete compliance with this legislation remains paramount for regulated firms in the UK. While manual compliance processes have been the norm for many … Read More

The three biggest challenges facing AML compliance teams in 2024

Amid increasing pressure from the regulators and ever-evolving legislation, modern financial institutions and regulated firms have bigger obligations than ever to ensure compliance and combat financial crime. We embarked on a comprehensive research journey towards the end of 2023 to … Read More

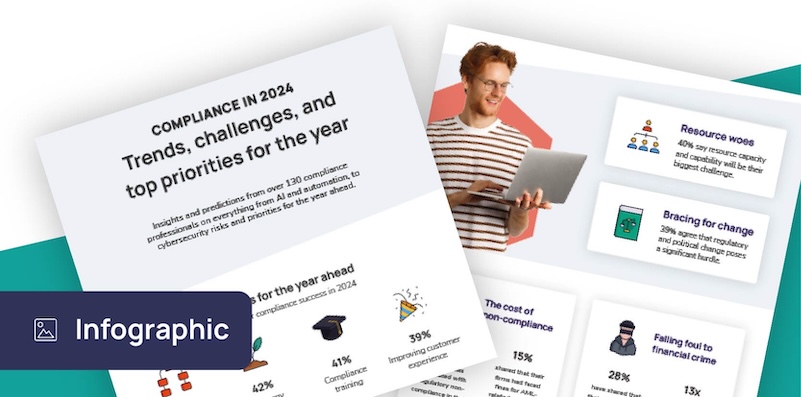

Infographic: Compliance trends in 2024

As the ever-present threat of money laundering, fraud, and financial crime continues to cast a dark shadow over entire financial systems, compliance and AML professionals continue to play a pivotal role in the war against financial crime. Did you know … Read More

3 AML compliance priorities for 2024

In 2023, professionals dealing with financial crime and AML compliance were busy handling geopolitical unrest, economic fluctuations, and evolving criminal tactics. In 2024, experts expect more regulatory changes, increased use of technology, and new methods to fight financial crime. As … Read More

What can AML professionals learn from Inventing Anna?

Inventing Anna, the 2022 Netflix series, takes viewers on a rollercoaster ride through the world of financial fraud and deception. While the show is undoubtedly entertaining, it also serves as a rich source of insights for Anti-Money Laundering (AML) compliance … Read More

How RegTech enhances AML search efficiency

In the ever-evolving landscape of financial regulations, Anti-Money Laundering (AML) compliance stands as a critical pillar for financial institutions worldwide. As the volume and complexity of financial transactions continue to grow, so does the need for efficient and effective AML … Read More

Behind the schemes: Inside the mind of a fraudster

In this article, we peel back the layers of deception and take a look at what makes fraudsters tick. With real-life case studies from an ex-fraudster, we take a look at the motives, strategies and evolving methodologies used by fraudsters. … Read More