Stop unnecessary compliance costs for your bank or building society

Achieve digital transformation with a tailored compliance solution for banks and building societies KYC processes. Meet your customer expectations for faster onboarding and reduce abandonment rates, whilst speeding up time to revenue.

How NorthRow help banks and building societies

High value customer data

Transform manual KYC processes that lead to poor customer due diligence and experience with a secure way to manage customer onboarding.

Efficient AML to fight crime

Using automated software provides consistency, accuracy and increased volume of KYC checks without increasing headcount.

Compliance consistency

Meet ever changing regulation for the banking industry and avoid costly fines with automated processes that help combat financial crime.

Protect your reputation

Mitigate reputational risk and reduce time spent on researching new legislative changes with a platform that is always up to date.

Banking and their KYC, KYB and due diligence

Over 10 years’ experience delivering AML solutions to the banking sector

Compliance teams within the banking sector are already using a wide range of onboarding and monitoring tools from NorthRow, including biometric facial recognition and liveness detection, through to automated banking KYC and KYB verification on international companies and individuals.

If you are regulated by MiFID II, we also provide fully automated client classification, suitability, appropriateness and cross border assessments on your clients.

Onboarding for the banking sector

Accelerated onboarding with RemoteVerify

New customers expect to be onboarded faster using digital technology. Banks and building societies can now onboard clients remotely and the latest biometric technology allows verification from anywhere at any time. Verification results are delivered in real-time to accelerate KYC onboarding to ensure banks and building societies stay ahead of their competition.

Remove manual processes

One supplier for banking KYC, AML and ongoing monitoring

Banks and building societies can no longer rely on manual spreadsheets. The regulators want to see the use of digital platforms for automated compliance processes. NorthRow’s unique, user-friendly platform delivers efficient end-to-end, KYC, AML and ongoing monitoring from one single platform.

Data security is front and centre

Automatic audit trail

WorkStation allows you to create workflows, store and export information at a click of a button, while providing assurance that all data is held on a secure platform making it easily accessible for both internal and external audits.

“

“NorthRow's ability to deliver a bespoke solution that combines automated identity checks with the added security of face-to-face verification made it the obvious choice when deciding which firm to partner with to securely deliver Open Banking.”

Nigel Spencer

Open Banking

Why NorthRow...

500k+ worldwide users

173 active countries

99.99% uptime

Banks and building societies face daily challenges in the battle against dirty money, often employing large numbers of staff to combat money laundering and financial crime. Regulators are imposing crippling fines and are now expecting to see digital solutions to counter the risk of financial crime, money laundering and fraud. NorthRow supports banks and building societies to achieve compliance quickly and cost effectively.

Banking KYC and KYB screening

Facilitate the complexity of compliance and reduce risk when onboarding new clients by verifying their identity and screening against sanctions lists, financial and shareholder information, as well as UBO details.

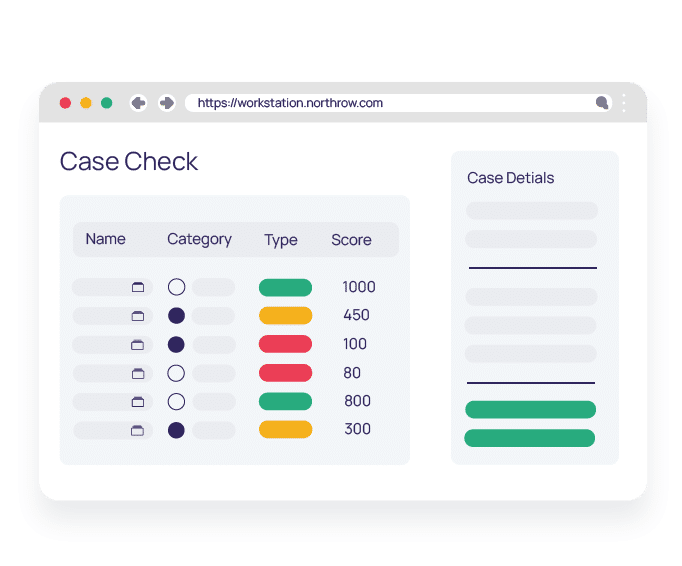

Case

management

Manage each individual and company with our simple case management solution, view results and set alerts where action is required to ensure due diligence and keep a record of all transactions for audit purposes.

ID&V and Right to Work

Simplify ID and verification with an easy-to-use case system which allows you to organise, update, and store information securely, and in line with GDPR and data protection regulations.

AML compliance

Keep track of your clients’ risk status using our RAG system and be alerted to any relevant changes, ensuring you meet ongoing AML compliance.

Ongoing monitoring

Automated alerts notify companies and individuals of risk profile changes, so you can keep tabs on political exposure, sanctions or adverse media.

Remediation

Improve efficiency with a risk-based approach to remediation and data collection processes minimising the administrative burden placed on your team.

Ready to get started?

Book your free demo of our comprehensive AML compliance solution for banks and building societies today.