Accelerate compliant person and merchant verification

Mitigate risk and reduce non-compliance using a digital platform that balances AML and CFT compliance responsibilities with customer experience.

How NORTHROW can help Payment service providers

Streamline onboarding

Screen clients with confidence against real-time sanctions list, PEPs, adverse media insights and watchlists.

Reduced abandonment

Quick and easy onboarding that delivers improved customer satisfaction and friction-free processing.

Compliance consistency

Meet ever-changing regulation for the payments industry and avoid costly fines with automation that removes the need for manual processes.

Achieve global compliance

Protect your payment processing company from fraud, money laundering and financial crime with access to truly global data sources.

Making onboarding easier for payment providers

Seamless onboarding that is safe and compliant

With international coverage and access to individual and company checks; ongoing monitoring; PEPs and sanctions screening for enhanced due diligence and data insights, NorthRow’s WorkStation is your comprehensive compliance platform.

KYC for payment providers

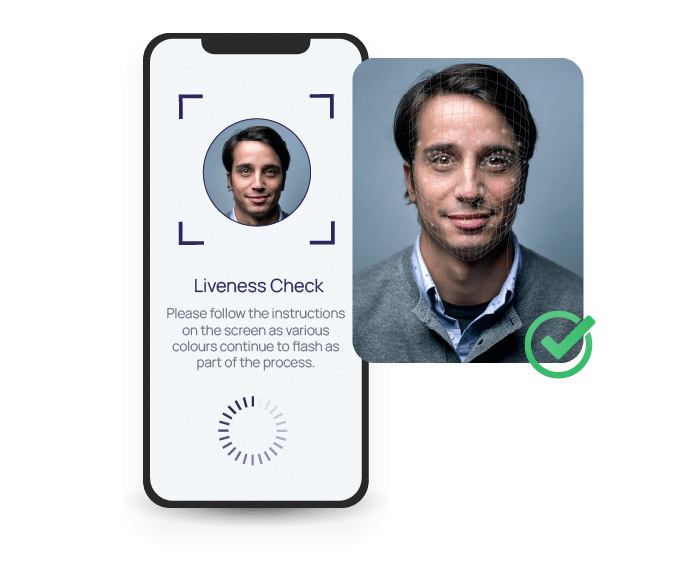

Know your customer identification

Conduct thorough customer and merchant due diligence effortlessly. With a vast array of leading, global data sources, verifying client identities as never been easier.

Stay ahead of competitors and verify customers in real-time using the latest biometric and liveness checking technology, ensuring comprehensive risk assessments and compliance with regulatory requirements.

- Seamlessly verify the identities of customers and merchants using advanced ID verification technology including biometric authentication, facial recognition and document analysis

- Streamline your onboarding processes, reduce false positives and ensure a memorable customer experience with our intuitive, scalable AML technology

KYB for PAYMENT PROVIDERS

Know your business verification

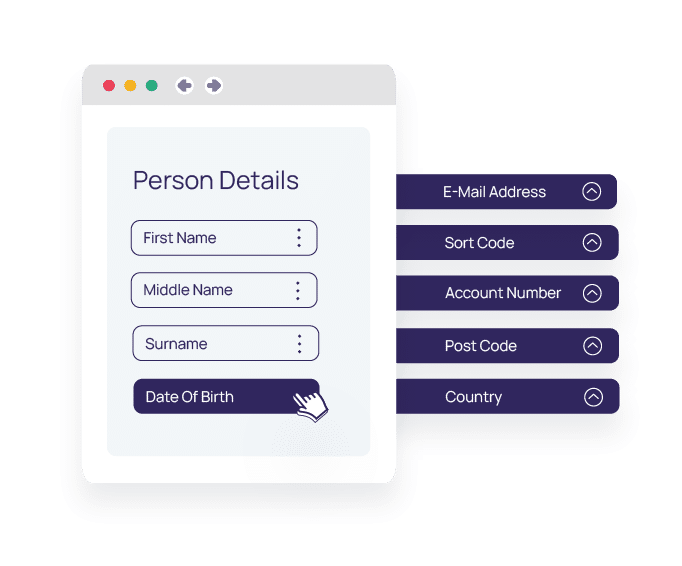

Traditional KYB risk assessment often falls short in gathering the nuanced risk profiles of corporate clients and merchants in the payments industry.

NorthRow delivers your KYB/AML obligations to screen and identify financial and shareholder information, as well as UBO details for even the most complex corporate structures.

- Conduct thorough due diligence on merchants, partners, and suppliers with automated data collection, analysis and verification for AML compliance

- Streamline compliance efforts by automating the collection and verification of complex corporate information such as registration documents, beneficial ownership, and financial statements

Due diligence for PAYMENT PROVIDERS

Screening and ongoing due diligence

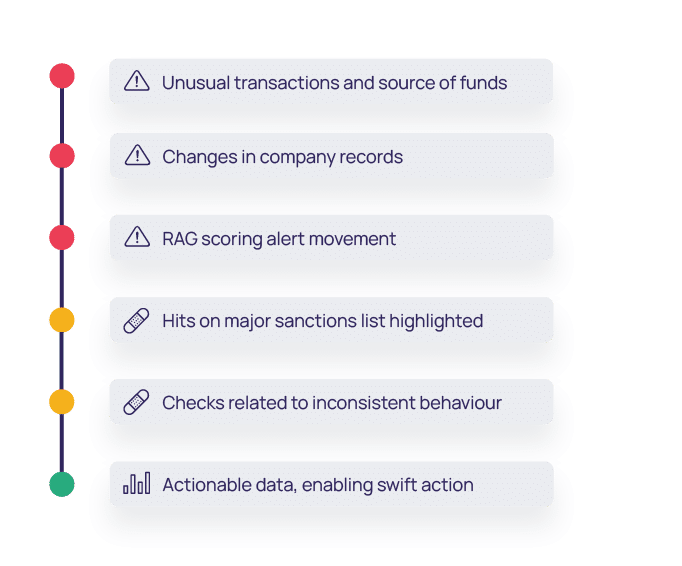

Track, monitor and receive real-time alerts from the world's leading data sources of any changes in company structure, beneficial ownership, or directorships to ensure ongoing compliance to meet AML regulations.

WorkStation automates compliance checks with customisable workflows that simplifies your onboarding, from identity verification to sanction screenings.

- Ensure round-the-clock client due diligence by screening against global watchlists, sanctions lists, PEP databases and adverse media sources

- Enhance the accuracy and effectiveness of your compliance efforts by automating screening and ongoing monitoring tasks, reducing manual input and human error

Got a question?

Frequently Asked Questions

For all of your burning questions, take a look at our FAQs below. Can’t find the answer to your question? Feel free to contact us directly and we’ll be happy to help.

WorkStation has been built from the ground up specifically for compliance professionals. It tackles the challenges inherent in conducting onboarding checks within the payment industry.

From dynamic risk scoring to seamless regulatory compliance automation, WorkStation empowers compliance leaders to navigate regulatory complexities with confidence and efficiency.

Unlike other alternatives, WorkStation provides a complete end-to-end KYC, KYB and ID&V solution for your firm’s CDD and EDD processes.

Leveraging a vast array of global data sources, WorkStation is able to effortlessly vet and verify both merchants and individual clients. With advanced data verification tools, adverse media, PEP and sanctions screening, UBO identification, and dynamic risk scoring, the platform facilitates comprehensive due diligence processes.

Absolutely! Our software is equpped with advanced technology to navigate the intricate landscape of client structures and beneficial ownership. Through comprehensive due diligence processes, WorkStation facilitates the identification and verification of beneficial owners, enabling your payments firm to comply with regulatory requirements and mitigate the risk of financial crime.

WorkStation boasts automated compliance workflows which can be fully configured to accommodate the evolving regulatory landscape that impacts your firms.

With our dynamic rule-based engine and customisable compliance checks, WorkStation helps your firm to adhere to regulatory requirements while minimising manual intervention and mitigating the risk of human error or oversight. From sanction screening to politically exposed person checks, WorkStation’s automated compliance checks empowers your payments firm to uphold regulatory compliance with ease.

Real-time screening against global watchlists and sanction lists is instrumental. With WorkStation, you can screen customers against global sanction and PEP watchlists including HMT, OFSI, OFAC, UN, EU and other sanctions from around the world with information updated in real-time.

Getting started is simple. Contact our team to schedule a personalised demo, where we’ll chat through your firm’s specific requirements and share how WorkStation can help you to overcome your compliance challenges.

Our implementation process is quick and efficient, ensuring minimal disruption to your operations while maximising the benefits of partnering with NorthRow.

“

“We’ve seen significantly shorter validation times – measured in seconds and minutes, rather than in days. NorthRow will be important to our planned expansion of services, and their team has given us complete confidence that we will benefit from their product roadmap in the months and years ahead.”

Chris Shorthouse, Director of Business Assurance and MLRO

CloudPay

Why NorthRow...

500k+ worldwide users

173 active countries

99.99% uptime

The easiest way for payment services firms to meet AML requirements is to use WorkStation for digital verification and ongoing monitoring.

WorkStation verifies, screens, manages the results, monitors, and provides a record of all transactions for audit purposes. As a single platform, it delivers all your payment firms KYC, KYB and ongoing monitoring requirements in an intuitive end-to-end solution.

Payments KYC and KYB screening

Facilitate the complexity of compliance and reduce risk when onboarding new clients by verifying their identity and screening against sanctions lists.

Case

management

Manage each individual and company with our simple case management solution, view results and set alerts where action is required to ensure due diligence.

ID&V and Right to Work

Simplify ID&V with an easy-to-use case system which allows you to organise, update, and store information securely, and in line with GDPR and data protection regulations.

AML compliance

Keep track of your clients’ risk status using our RAG system and be alerted to any relevant changes, ensuring you meet ongoing AML compliance.

Ongoing monitoring

Robust monitoring functionality that analyses clients and merchants in real-time for any changes in risk profile, so you can proactively mitigate financial crime threats and safeguard your business.

Remediation

Improve efficiency with a risk-based approach to remediation and data collection processes minimising the administrative burden placed on your team.

Ready to get started?

Book your free demo of our comprehensive AML compliance solution for payment services today.