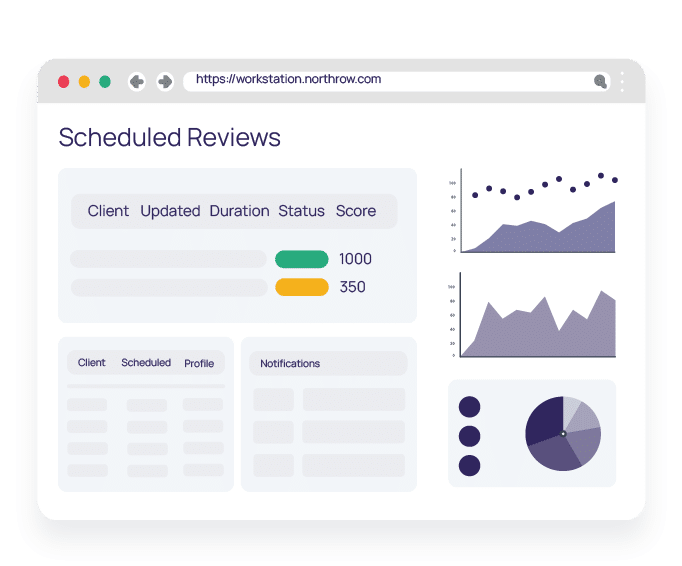

Actively monitor your client risk profiles

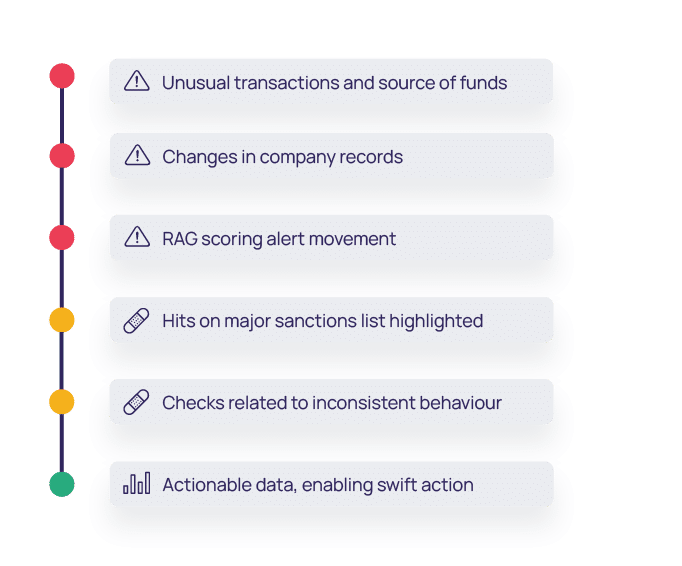

Automated client monitoring that alerts you of any risk profile changes to both companies and individuals in real-time, so you can keep tabs on political exposure, sanctions or adverse media and ensure you remain compliant with minimal manual input.

Benefits

Take proactive action to minimise risk exposure

Detailed insights into all relevant changes to a customer’s profile are issued in real-time, so you can initiate enhanced checking protocols to mitigate any risk swiftly.

Fully customisable for relevance

Increased efficiency with only the most relevant risk alerts issued to your team.

Meet all compliance regulations

Remain compliant with our leading coverage of PEPs, sanctions and adverse media data.

Monitor clients in real-time

Real-time alerts of changes in your clients' risk status ensure your business can act quickly.

Customise

Make monitoring work for you

The highly configurable solution ensures that your business only sees relevant alerts on companies, individuals or both, minimising the time wasted looking at irrelevant, disparate information.

Improve

Automated client monitoring processes

In-built client monitoring automation gives you the ability to choose the frequency of checks and automatically screen a customer against relevant sources to meet ongoing compliance monitoring requirements.

Manage

Understand your customer throughout their lifecycle

A complete activity log builds a true understanding of all changes impacting a customer’s risk profile, from the moment they were onboarded and throughout their lifecycle.

“

"The flexibility of NorthRow’s platform and API enables us to deploy the right services for our business without compromising our control frameworks and policies."

Stuart Cronin

CashFlows Payments

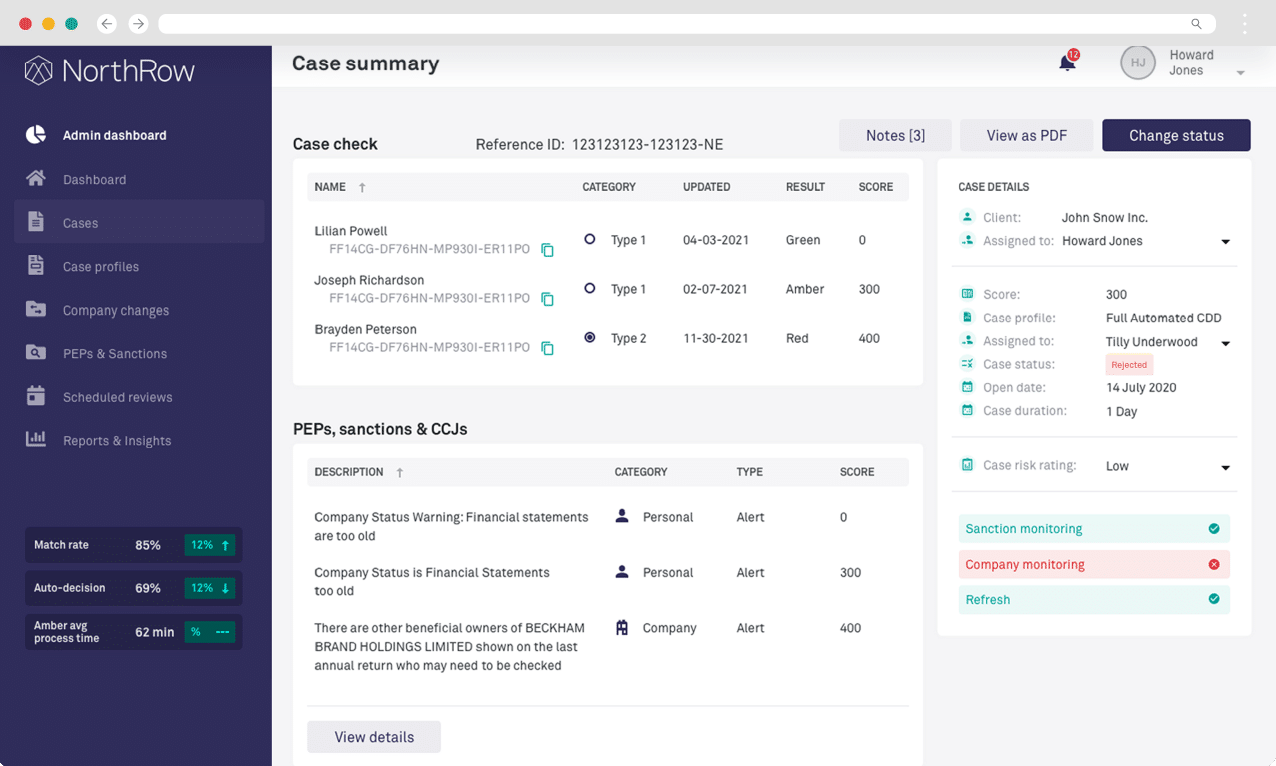

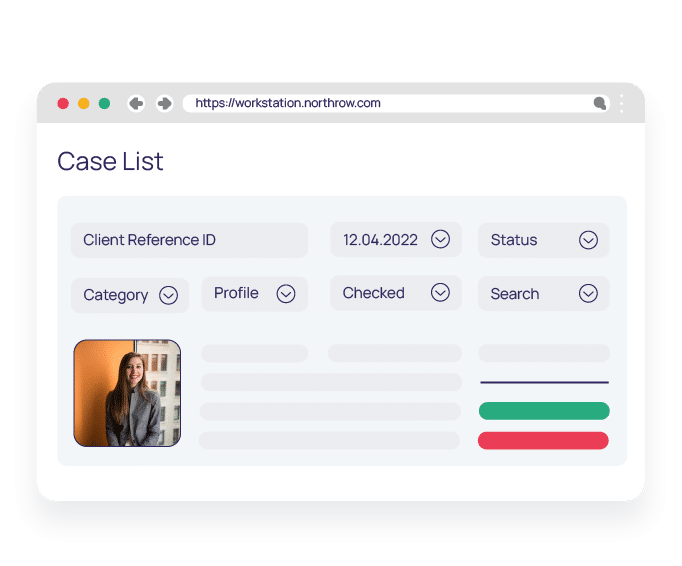

Examine flagged cases

Real-time alerts flag cases that require further investigation. Tailor the work flows to match your business risk profile and remain compliant for Ultimate Beneficial Ownership, PEPs, sanctions and adverse media.

Enrich customer data

Ensure the data held on customers, for AML compliance purposes, is comprehensive and up to date, reflecting current circumstances.

An accurate view on risk

Maintain an accurate view of a customer and understand changing risk exposure to safeguard against financial crime.

Adhere to regulations

As regulations change, ensure your AML processes remain compliant with a clear view of customer profiles throughout the lifecycle of a relationship.

Ready to get started?

Book your free demo of our comprehensive AML compliance solution today and start automating your client monitoring.