AML compliance for wealth management firms

Streamline your wealth management risk policy and reduce the burden of manual compliance to meet regulatory requirements.

How NorthRow helps wealth management firms

Remote onboarding

Reduce client onboarding times from days to minutes, with secure verification services available anywhere, at any time.

Comprehensive due diligence

Simplify processes for identifying source of wealth and funds to satisfy strict regulatory requirements for enhanced due diligence.

Compliance consistency

Intelligent automated workflows reduce human error, improve productivity and ensure consistency for audit purposes.

Understand every risk

Understand where clients undertake business activities, screen for PEPs and sanctions, adverse media and beneficial ownership.

Wealth management KYC/B and due diligence

Financial crime risk management for wealth managers

The regulatory scrutiny of wealth managers and private banks is only going to continue to increase. Review processes for identifying source of wealth and funds, and develop risk-based profiles for each client using an intelligent platform that is constantly updated as new regulation is delivered.

KYC for wealth managers

Know your customer identification

Remove repetitive and highly manual processes, across siloed data by introducing workflows to reduce the backlog of traditional KYC periodic review cycles.

KYB for wealth managers

Know your business verification

Efficient KYB onboarding for your corporate customers that screens and identifies financial and shareholder information, as well as UBO details for even the most complex of corporate structures.

Due diligence for wealth managers

Investigate clients for enhanced due diligence

Update client records relating to beneficial ownership of corporate records and understand control structures. Deliver EDD and ongoing monitoring when considering additional high-risk factors more efficiently.

“

"It is crucial for us not only to be compliant but also to safeguard our clients and the integrity of our brand. With NorthRow’s help, we can not only streamline client onboarding and meet AML regulations, but we know that we have the best due diligence and fraud protection system in the market."

Zain Mirza, Head of Operations

Blend Network

Why NorthRow...

500k+ worldwide users

173 active countries

99.99% uptime

WorkStation was designed with compliance professionals in mind. We pride ourselves on always putting our users first and ensuring that our software works for compliance teams regardless of the size, volume or complexity of checks required.

As a single platform it delivers all your KYC, KYB and ongoing monitoring in an intuitive end-to-end solution. WorkStation verifies, screens, manages the results, monitors, and provides a record of all transactions for audit purposes.

Wealth manager KYC and KYB screening

Facilitate the complexity of compliance and reduce risk when onboarding new clients by verifying their identities and screening against sanctions lists.

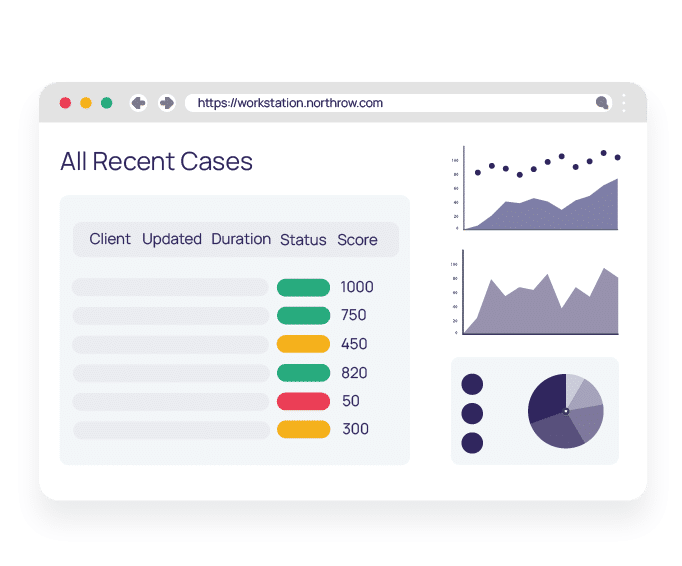

Case

management

Manage each individual and company with our simple case management solution, view results and set alerts where action is required to ensure due diligence.

ID&V and Right to Work

Simplify ID&V with an easy-to-use case system which allows you to organise, update, and store information securely, and in line with GDPR and data protection regulations.

AML compliance

Keep track of your clients’ risk status using our RAG system and be alerted to any relevant changes, ensuring you meet ongoing AML compliance.

Ongoing monitoring

Automated alerts notify companies and individuals of risk profile changes, so you can keep tabs on political exposure, sanctions or adverse media mentions.

Remediation

Improve efficiency with a risk-based approach to remediation and data collection processes that minimise the administrative burden placed on your team.

Ready to get started?

Book your free demo of our comprehensive AML compliance solution for wealth management firms and private banks today.