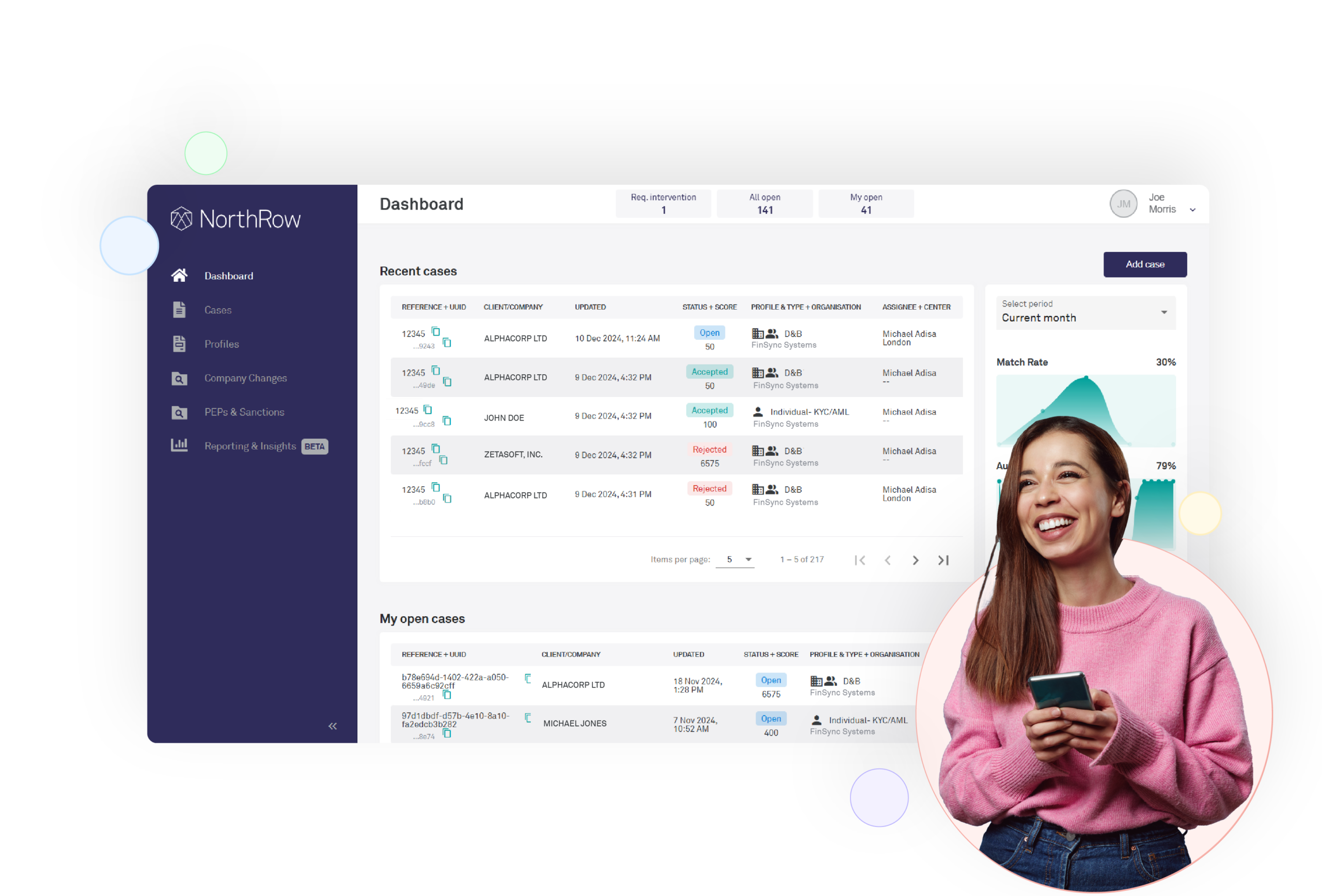

Anti-Money Laundering (AML) Software

AML software to uncover client risk and strengthen compliance

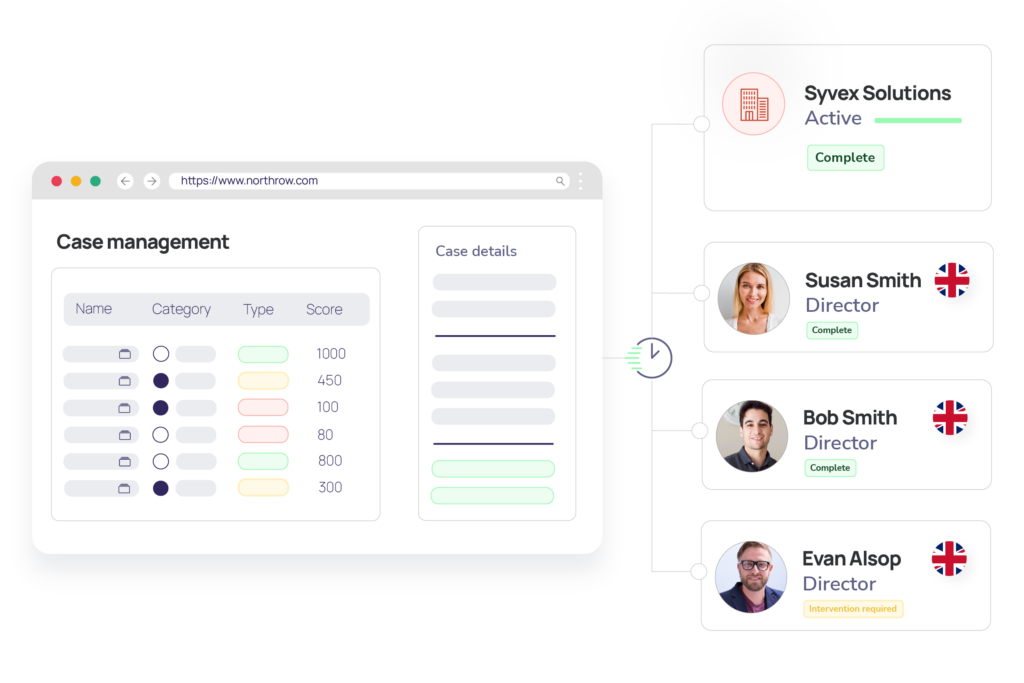

- Automate KYC, KYB and ongoing monitoring

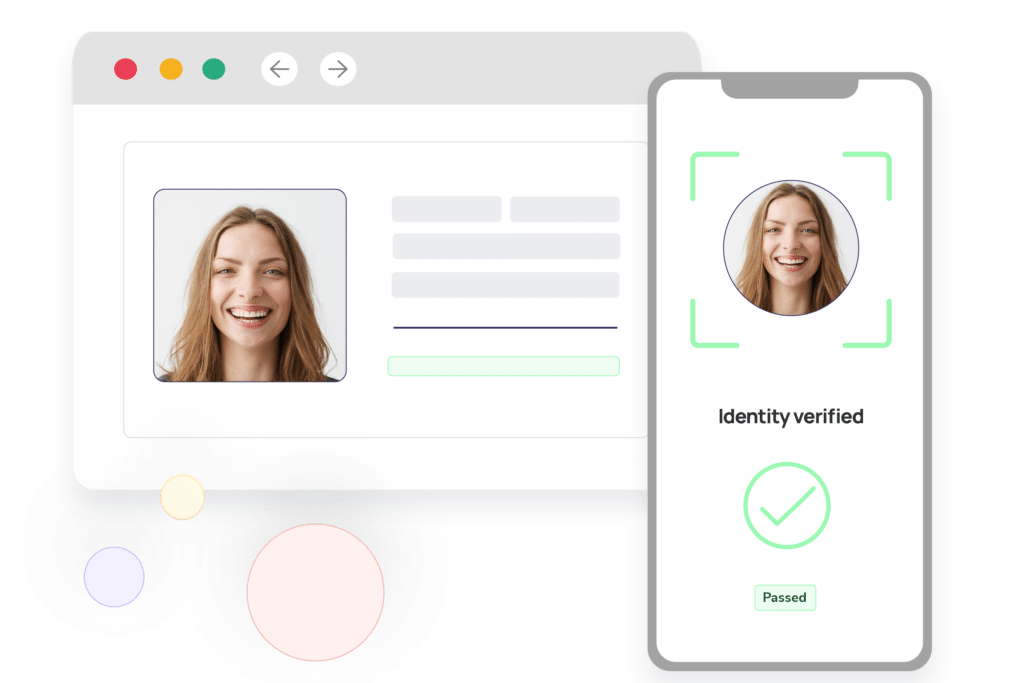

- Speed up risk screening and client verification

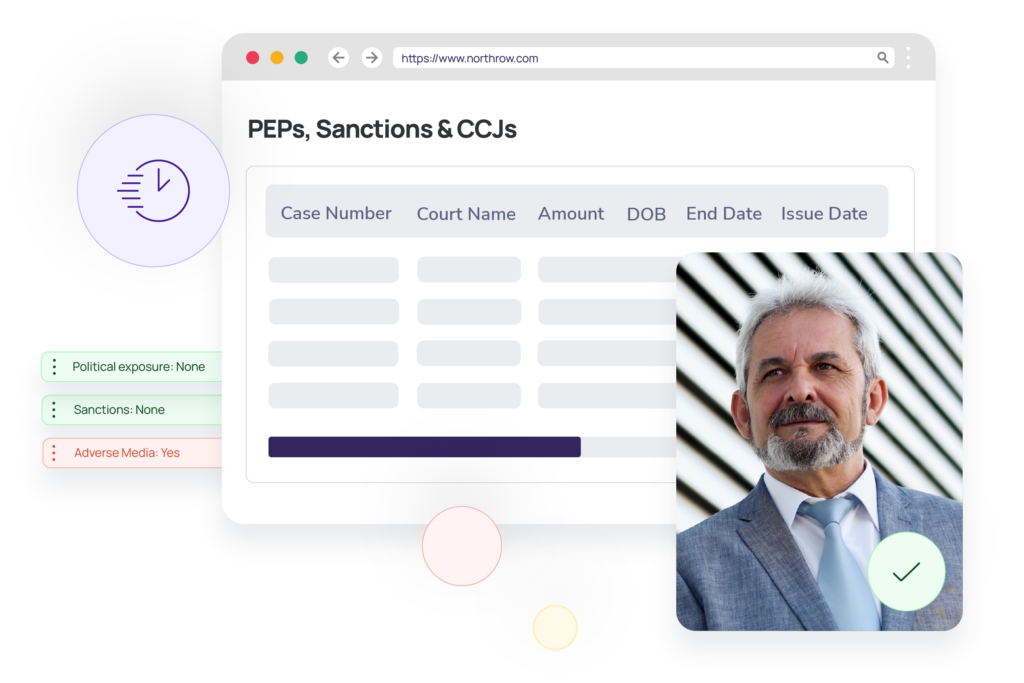

- Identify PEPs, sanctions and adverse media instantly

- Tailor controls to your risk-based approach

- Configure workflows to meet evolving regulations