AML compliance for fintechs

Streamline compliance and prevent fraud with accurate KYC & KYB

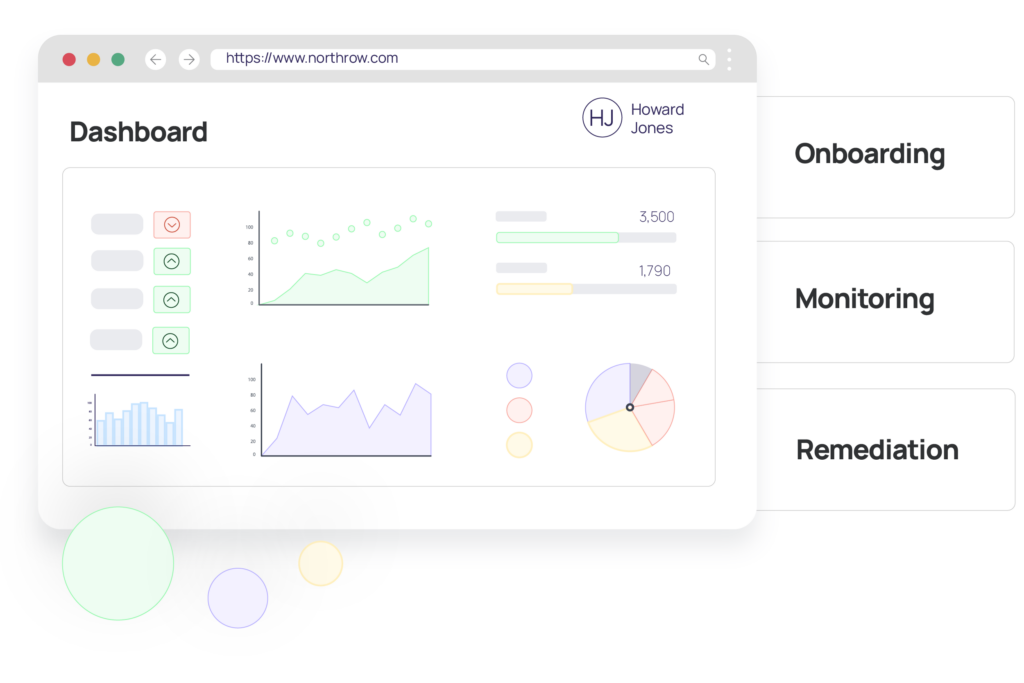

Take the headache out of AML compliance with our automated KYC, KYB, and ID&V solutions. Verify identities, perform AML screening, monitor ongoing risks, and manage cases – all from one intuitive dashboard.

Request Demo

👋 Hi, let’s schedule your demo.

Tell us a bit about yourself.

“

The system efficiently and effectively completes our KYC and KYB verification requirements during onboarding.

Robin Kear

Senior Account Executive