Client risk for accountancy

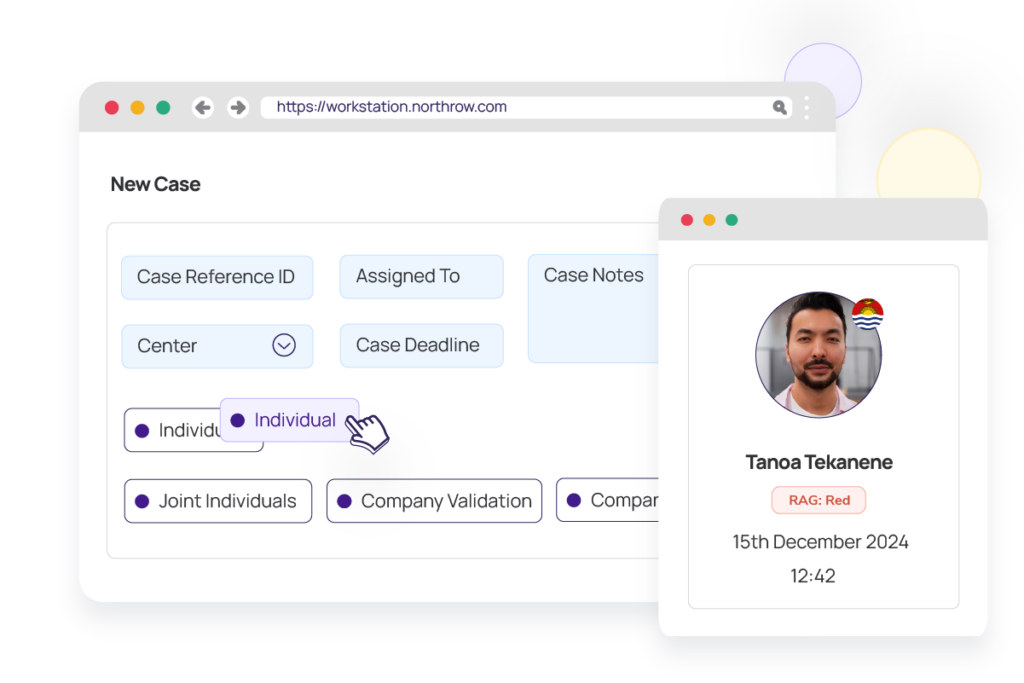

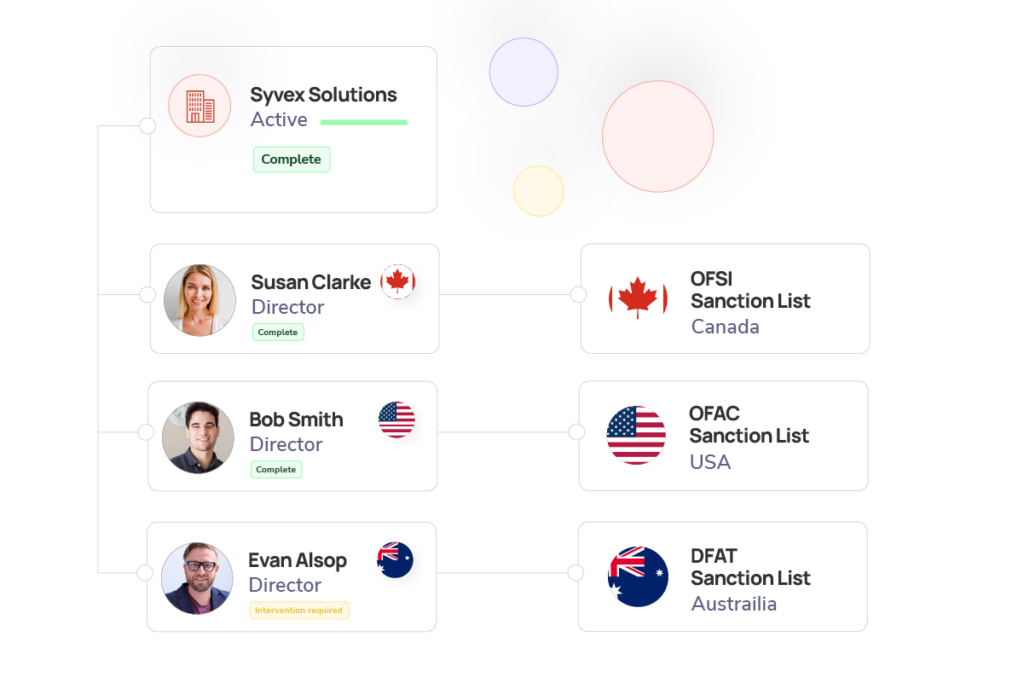

Refine risk assessments for complex structures and clients

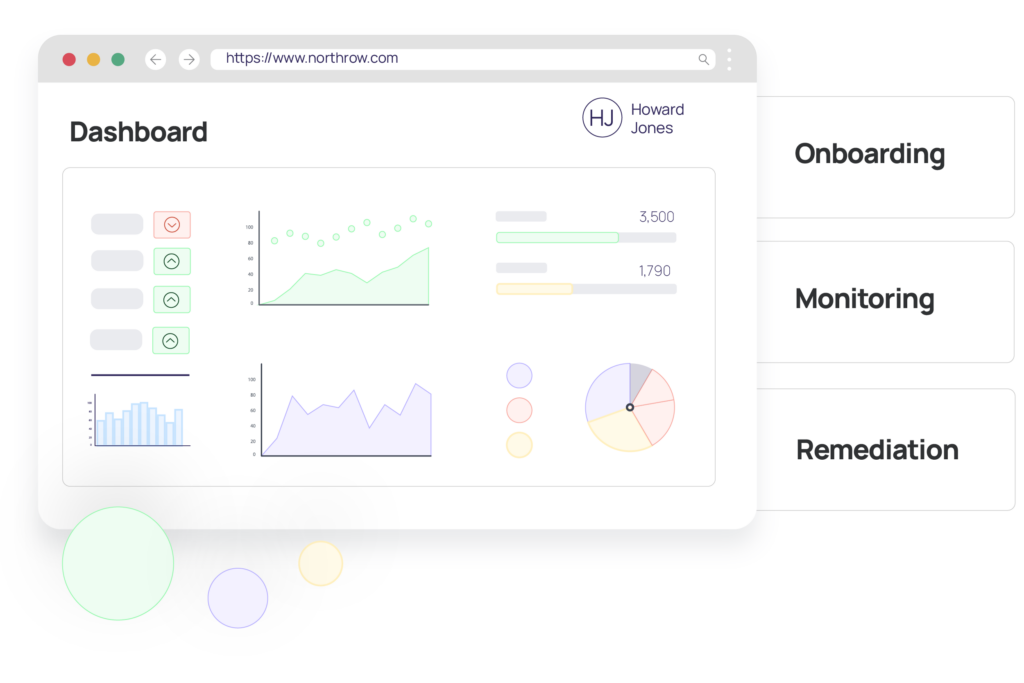

Accurately assess client risk, whether managing complex business structures or international clients, all while ensuring full compliance with key AML regulations and maintaining transparency.

Request Demo

👋 Hi, let’s schedule your demo.

Tell us a bit about yourself.

“

The system efficiently and effectively completes our KYC and KYB verification requirements during onboarding.

Robin Kear

Senior Account Executive