AML and risk for the legal sector

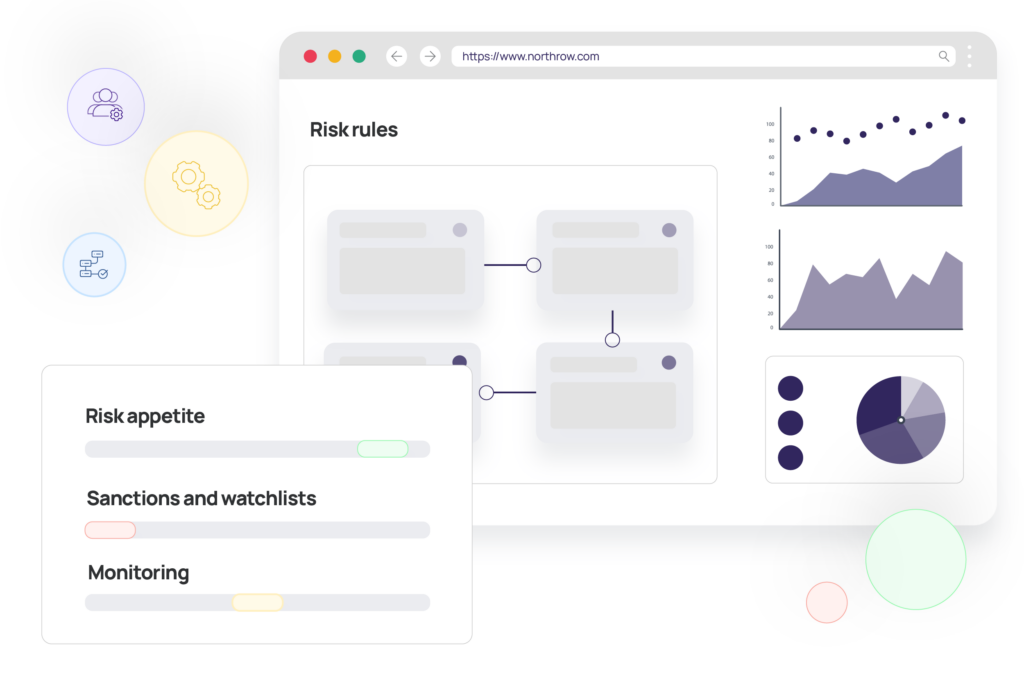

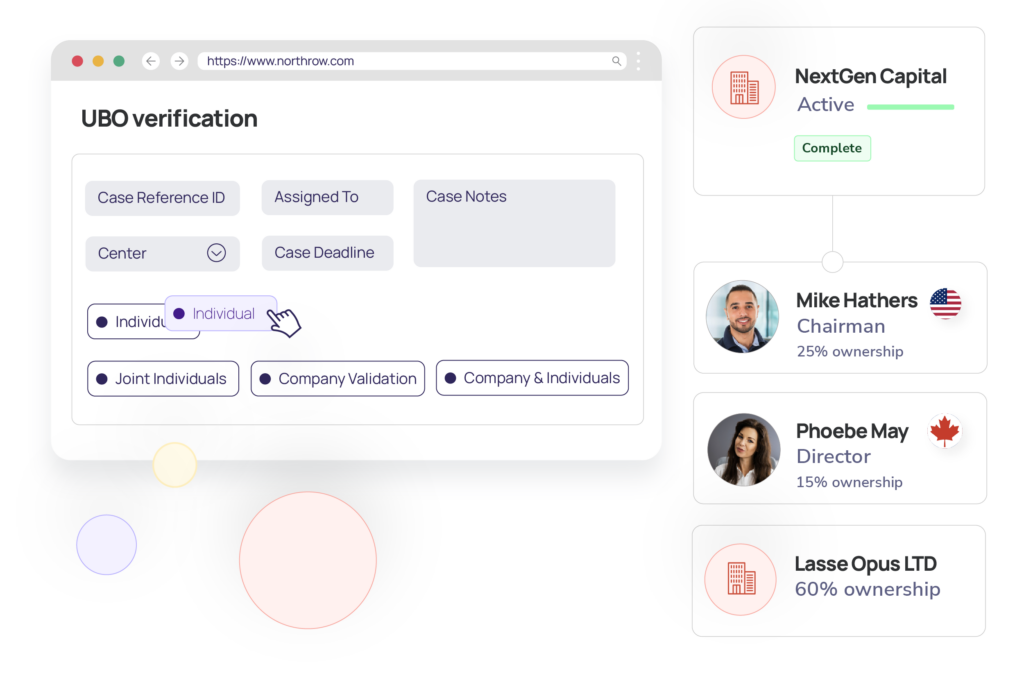

Utilise robust risk assessments to mitigate potential threats.

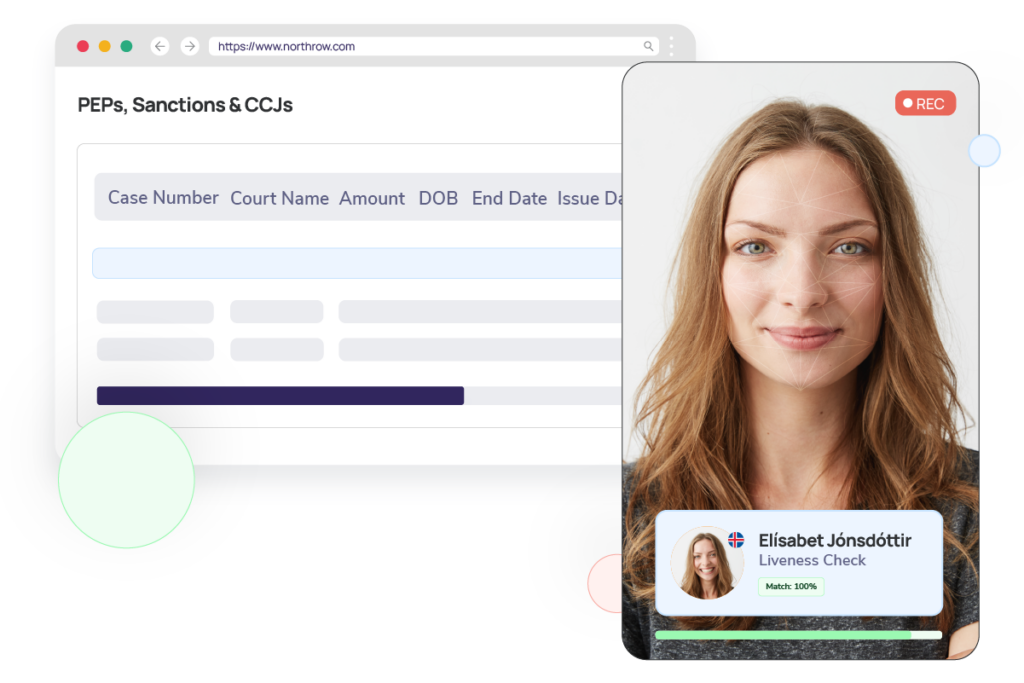

Automate the entire AML process to improve your firm’s risk assessment with up to 95% auto-decision rate, giving fee earners freedom and the people dealing with compliance to focus on the cases that require further investigation.

Request Demo

👋 Hi, let’s schedule your demo.

Tell us a bit about yourself.

“

The system efficiently and effectively completes our KYC and KYB verification requirements during onboarding.

Robin Kear

Senior Account Executive