Robust onboarding for payments

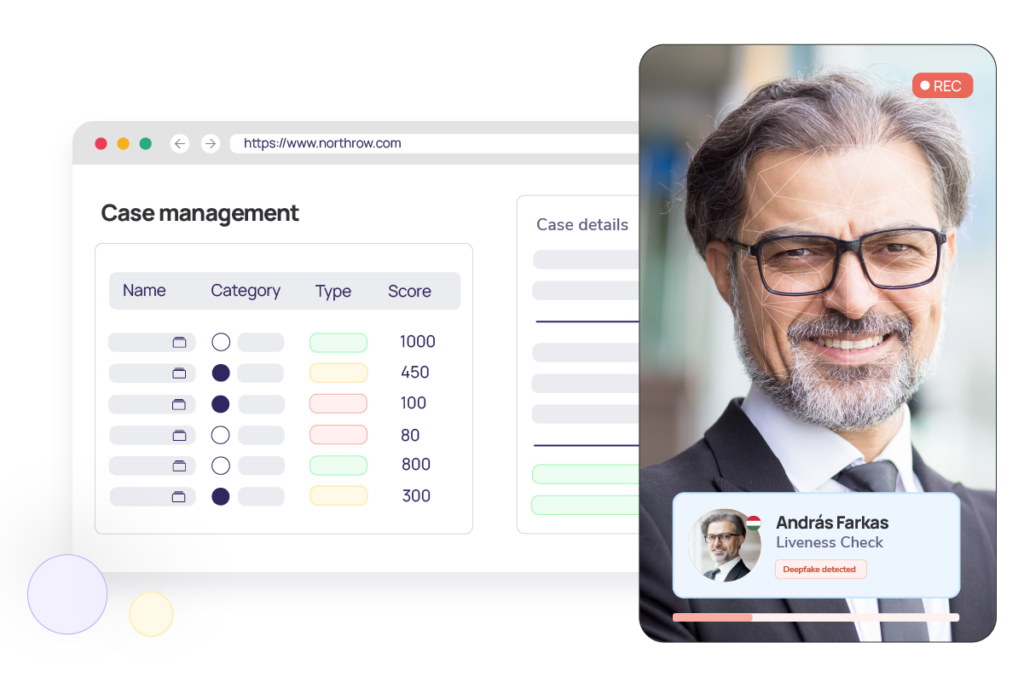

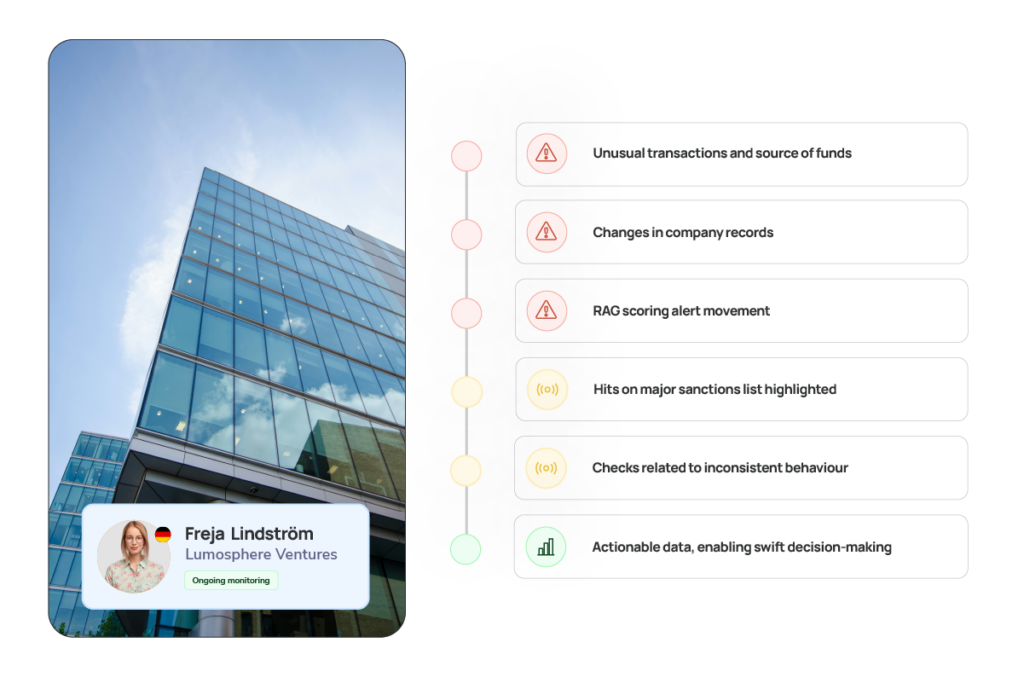

Unlock faster payments with integrated KYC and AML safeguards

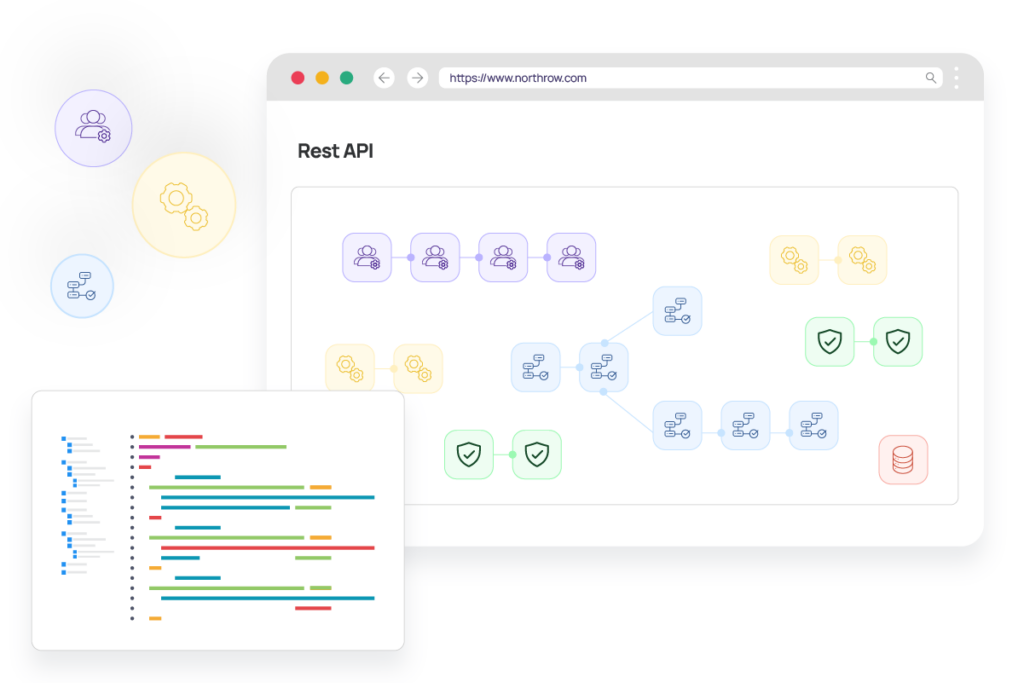

Onboard merchants with complex global structures effortlessly using a solution built to fit seamlessly into your workflows. Our platform simplifies compliance, speeds up onboarding, and offers customisable verification across jurisdictions.

Request Demo

👋 Hi, let’s schedule your demo.

Tell us a bit about yourself.

“

The system efficiently and effectively completes our KYC and KYB verification requirements during onboarding.

Robin Kear

Senior Account Executive