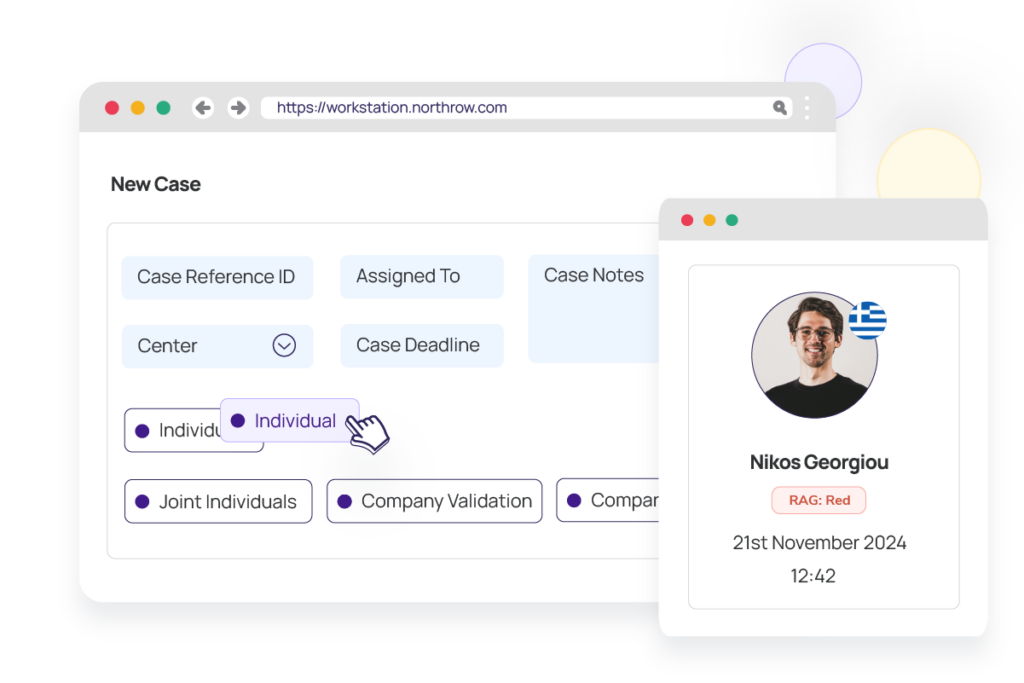

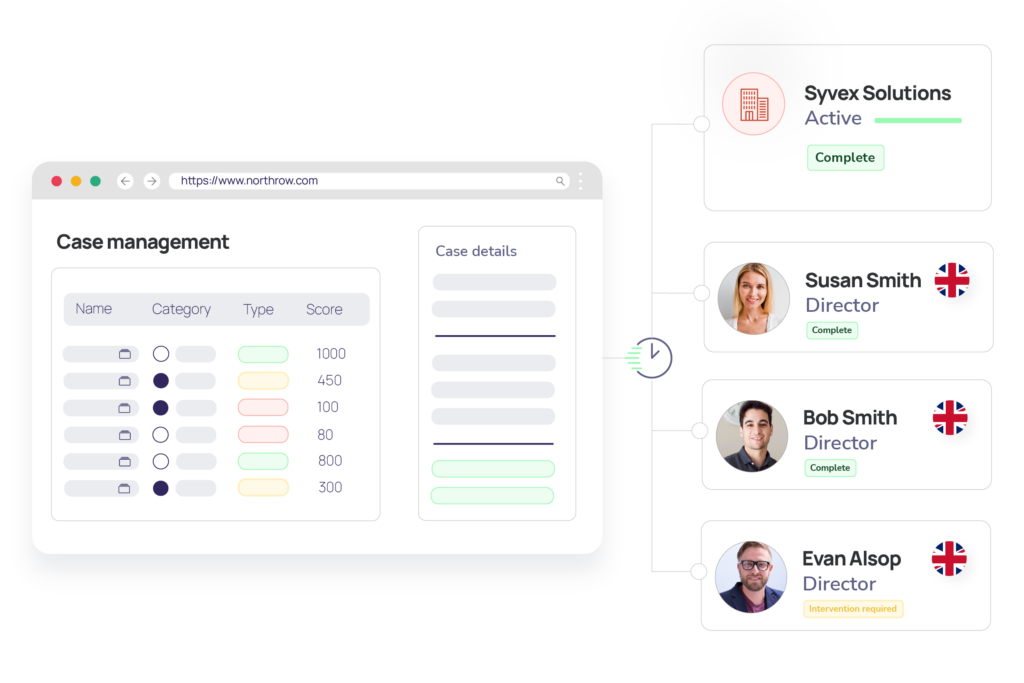

Customer remediation software

Automate client remediation to streamline processes.

Update customer information and address incomplete CDD data to meet AML regulations to ensure every client risk profile is accurate, complete, and up-to-date. Automate the remediation process to minimise business risk, streamline workflows, and take your customer service to new heights.

Request Demo

👋 Hi, let’s schedule your demo.

Tell us a bit about yourself.

“

The system efficiently and effectively completes our KYC and KYB verification requirements during onboarding.

Robin Kear

Senior Account Executive