Global onboarding for cryptocurrency

Overcome cross-border frameworks and reshape crypto onboarding

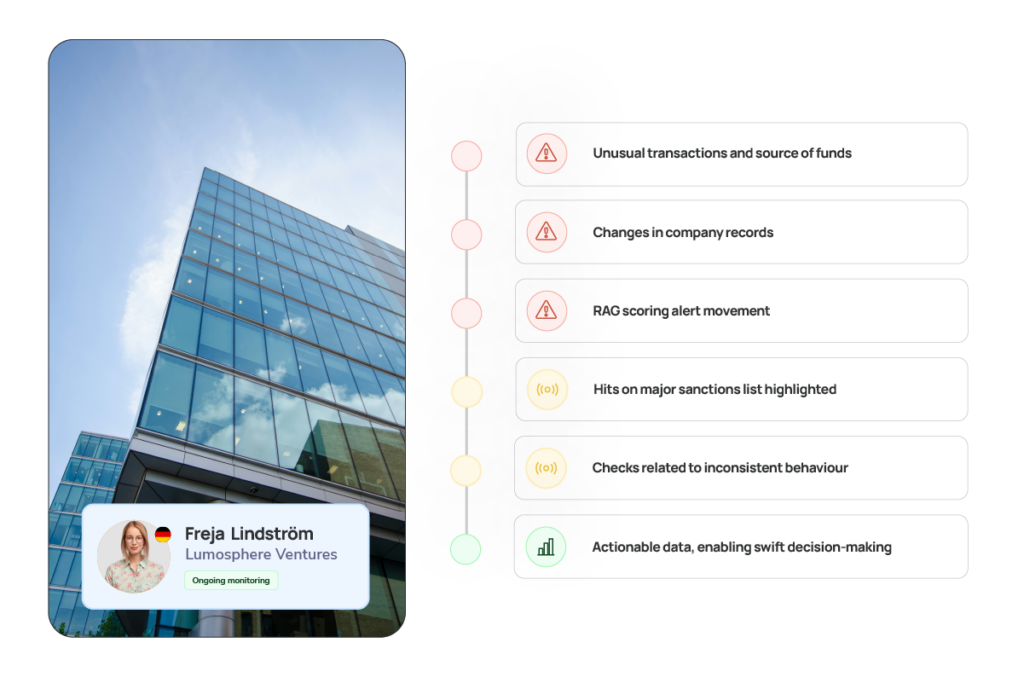

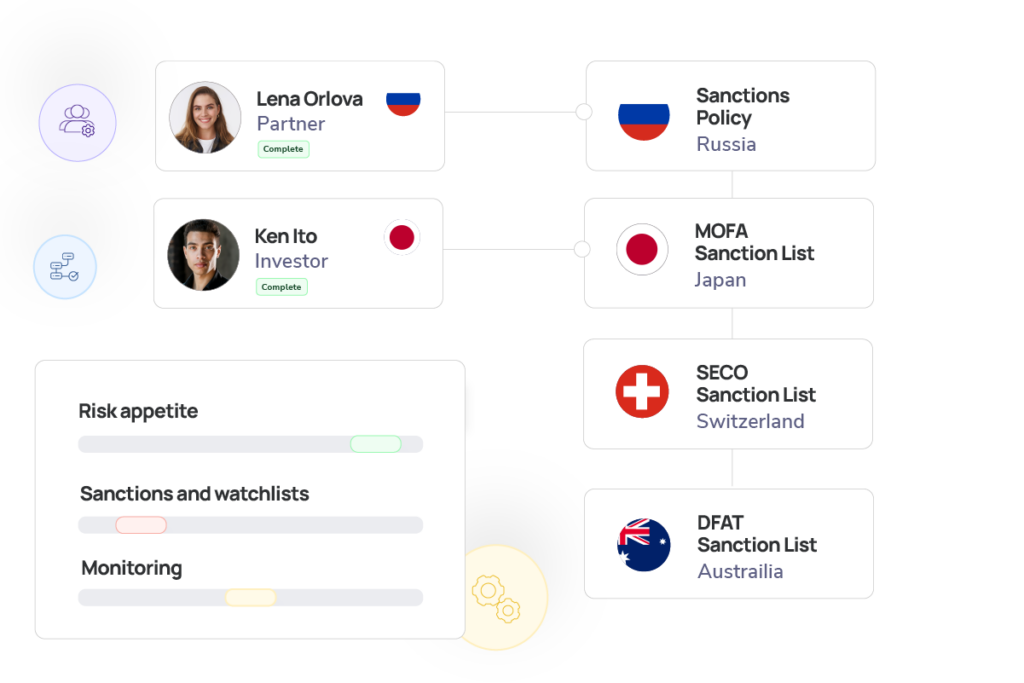

Streamline crypto compliance across jurisdictions to effectively manage differing KYC and KYB requirements, minimising legal and financial risks while ensuring seamless adherence to diverse regulatory standards worldwide.

Request Demo

👋 Hi, let’s schedule your demo.

Tell us a bit about yourself.

“

The system efficiently and effectively completes our KYC and KYB verification requirements during onboarding.

Robin Kear

Senior Account Executive