Optimising onboarding for investment banks

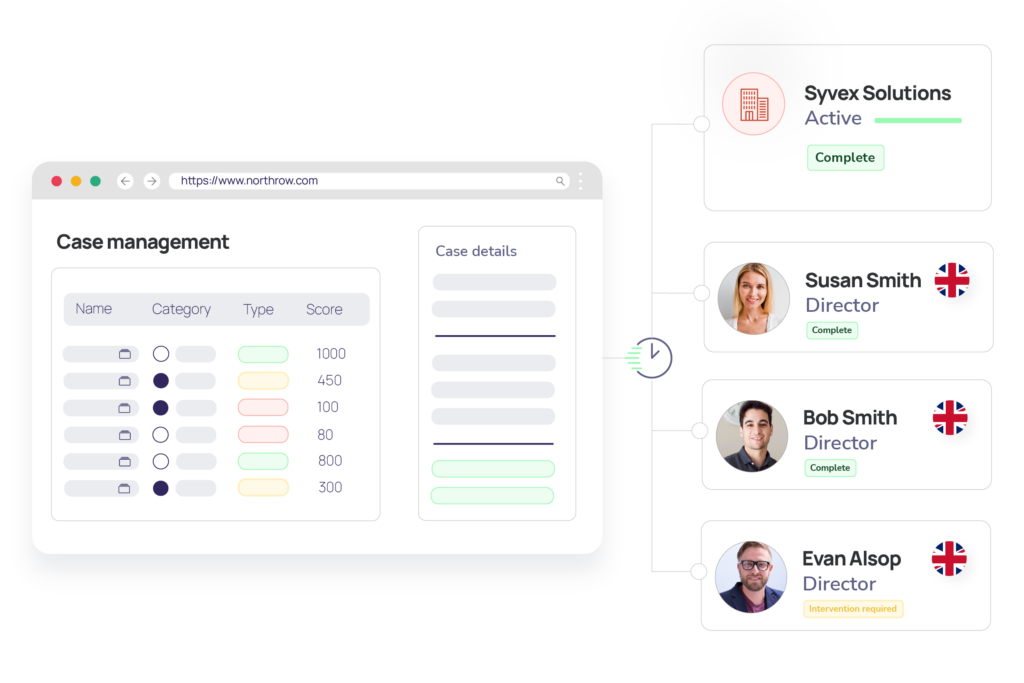

Refining client journeys with robust onboarding and monitoring

Facilitate operations to minimise your daily compliance costs and ensure adherence to evolving regulations to navigate the growing regulatory scrutiny investment banks face without compromising efficiency.

Request Demo

👋 Hi, let’s schedule your demo.

Tell us a bit about yourself.

“

The system efficiently and effectively completes our KYC and KYB verification requirements during onboarding.

Robin Kear

Senior Account Executive