AML checks for estate agents

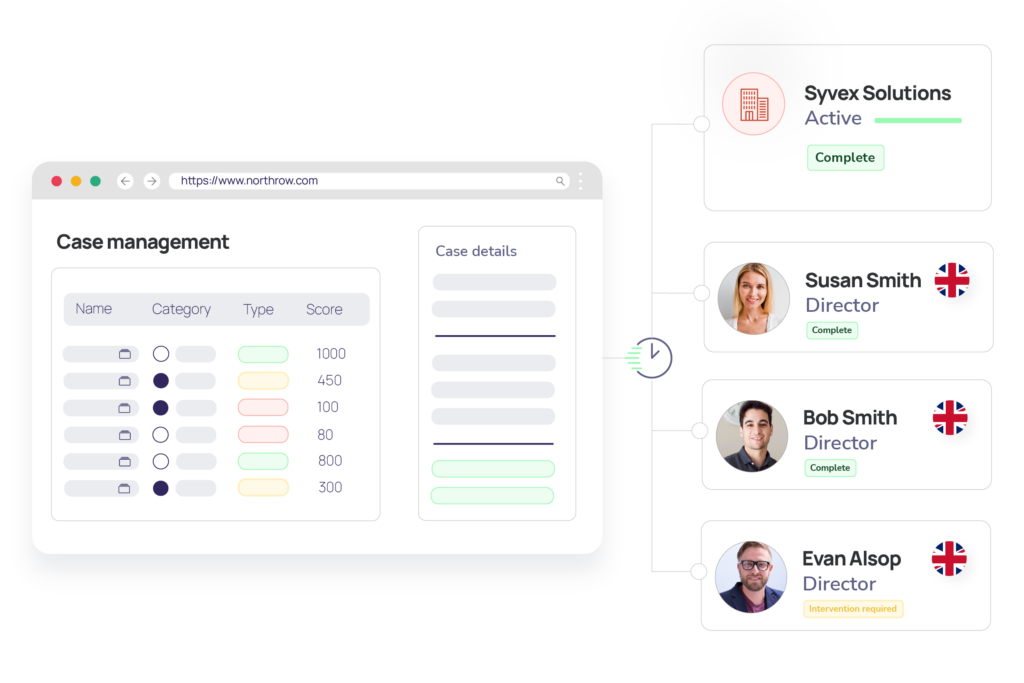

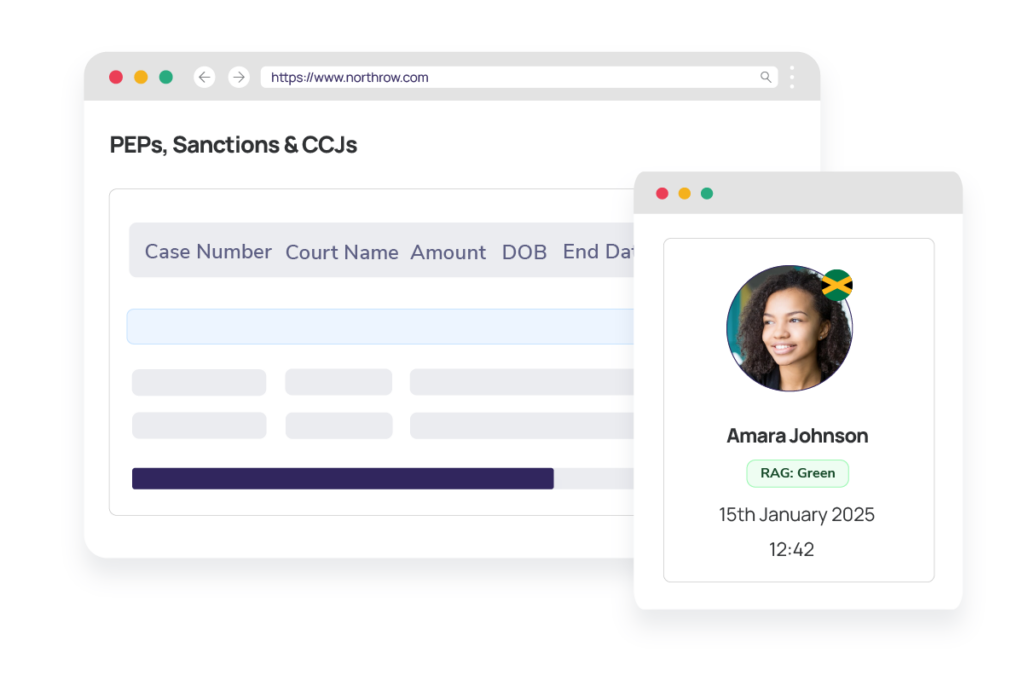

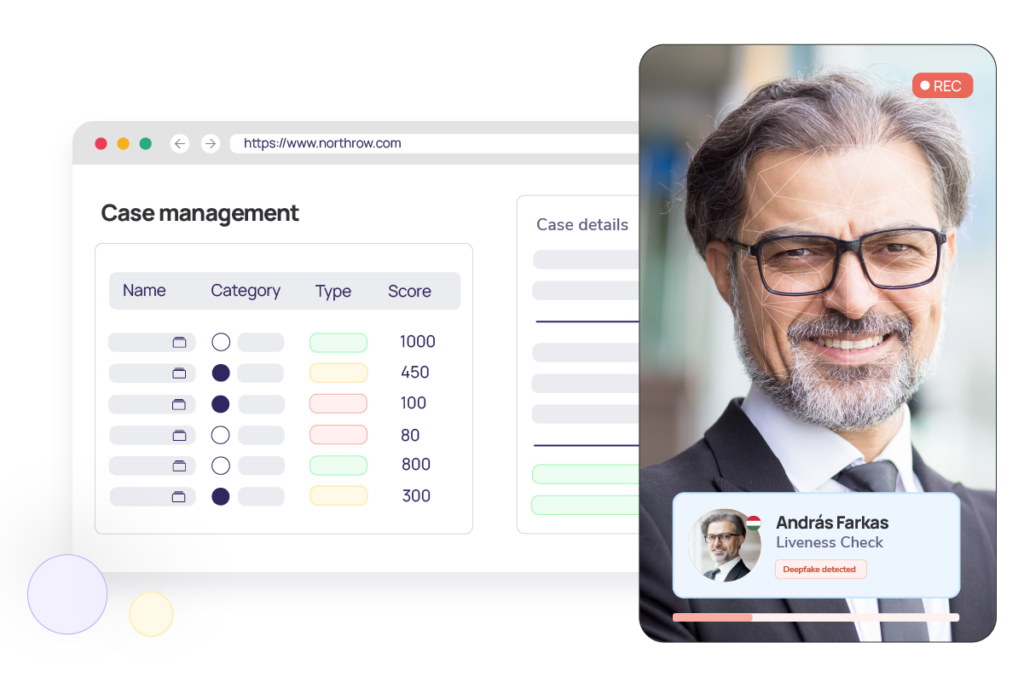

Instantly reduce risk with seamless AML checks for estate agents

NorthRow, a certified IDSP under the UK Government’s Digital Identity & Attributes Trust Framework, ensures secure, compliant digital onboarding with support for 220+ jurisdictions, 13,000 documents, and 85% verification accuracy.

Request Demo

👋 Hi, let’s schedule your demo.

Tell us a bit about yourself.

“

The system efficiently and effectively completes our KYC and KYB verification requirements during onboarding.

Robin Kear

Senior Account Executive