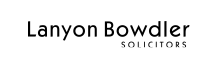

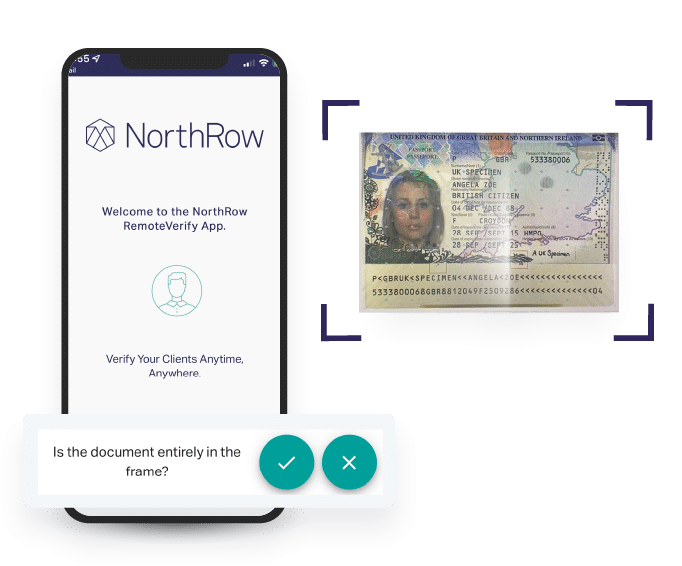

Remote client onboarding made easy.

With RemoteVerify, create a frictionless remote onboarding experience by allowing your customers to sign up and be verified in minutes, at their own convenience, using their own device, anywhere, at any time.

Trusted by hundreds of companies to digitally transform their compliance processes.

Rated 4.5 out of 5

Hi 👋 Let's schedule your demo.

Tell us a bit about yourself!