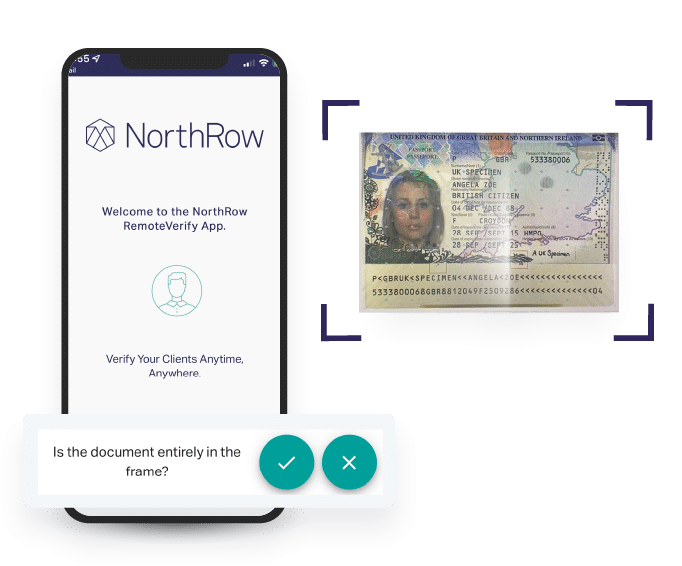

Onboard your customers in seconds, not days.

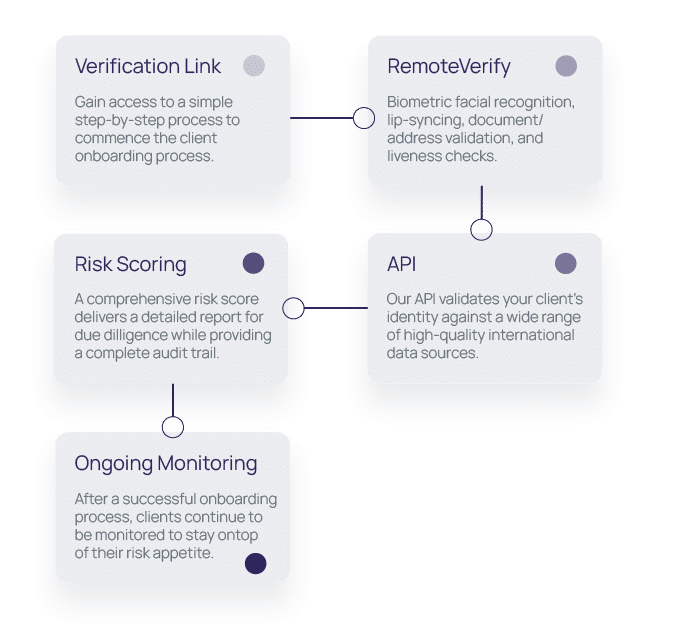

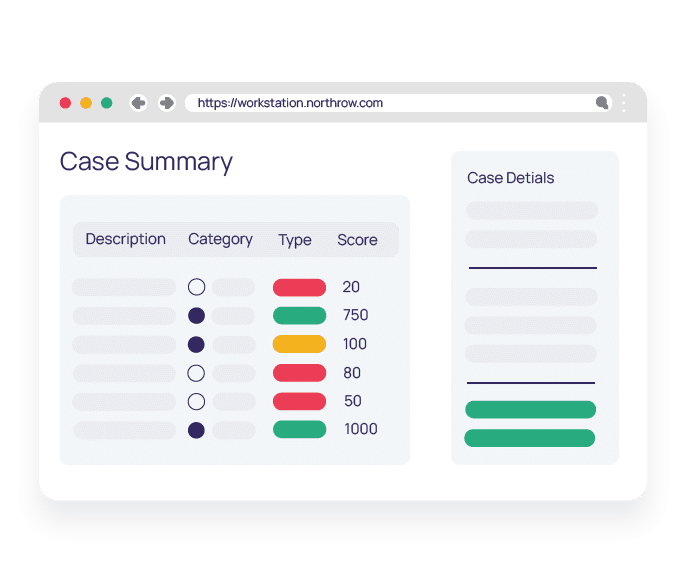

Client onboarding made easy with our integrated platform that automates verification, evaluates risk, and simplifies compliance with evolving regulations, such as AML (Anti-Money Laundering) and KYC (Know Your Customer).

Trusted by hundreds of companies to digitally transform their compliance processes.

Rated 4.5 out of 5

Hi 👋 Let's schedule your demo.

Tell us a bit about yourself!