NEW

Shifting the perspective: Transforming KYB into a business enabler. Download guide today >

Streamline KYB compliance and reduce risk with automated ID verification, PEP, sanctions and watchlist screening, enhanced due diligence, and AML workflows.

Validate businesses against public and commercial sources, checking stakeholder identities, as well as complex business structures and ultimate beneficial owners.

Reduce the time to revenue by speeding up KYB checks and focus on growing your business, safely.

Make better risk-based decisions based on data you gather about the businesses you onboard and continue to monitor.

Real-time identification of high risk businesses and custom alerts to stay on top of client changes.

Streamline KYB processes with a solution that provides actionable intelligence on your corporate customers, so you can make informed decisions with confidence.

Ensure the legitimacy of corporate clients, beneficial owners and associated companies with automated ID, fraud, PEPs, Sanctions, Adverse media, company and individual checks.

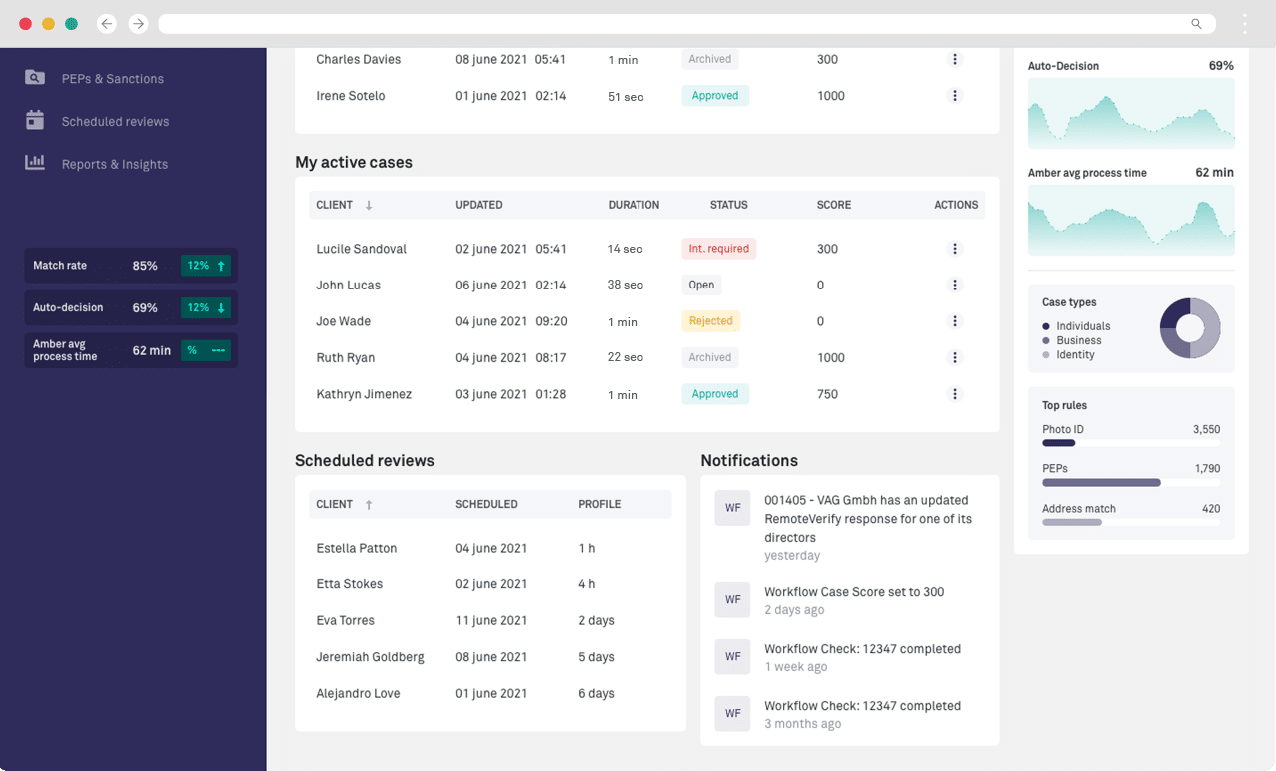

Automated data analysis identifies bottlenecks, cases which are auto-approved, average processing times and more, so you can continually improve your KYB compliance and risk management processes.

Continuously monitor businesses for any changes in their risk profile, including changes in ownership, adverse media and credit reference agency information.

Say goodbye to manual, time-consuming processes. Our KYB software streamlines operations, allowing you to achieve more in less time, without sacrificing accuracy.

Stay one step ahead of potential risks with our comprehensive ongoing monitoring technology. Identify and mitigate risks proactively, safeguarding your firm's reputation

Reduce operational costs associated with compliance with our cost-effective KYB solution. Eliminate the need for manual labour and reduce the risk of costly fines.

Rest easy knowing that your firm is always compliant with the latest regulations. Our KYB software provides you with the tools and insights you need to navigate complex regulatory landscapes with ease.

Access to accurate and up-to-date KYB data and insights empowers your business to make informed decisions confidently, driving your firm towards success.

Our KYB software offers customisable features and flexible deployment options, allow you to tailor the solution to meet the unique needs of your firm, our software can adapt to your requirements seamlessly.

“

“One of the most significant benefits of WorkStation has been the automation of our end-to-end compliance processes, allowing us to focus our efforts on high-risk cases. The software has saved us valuable time and resources.”

Joanne Miller

Hargreaves Lansdown

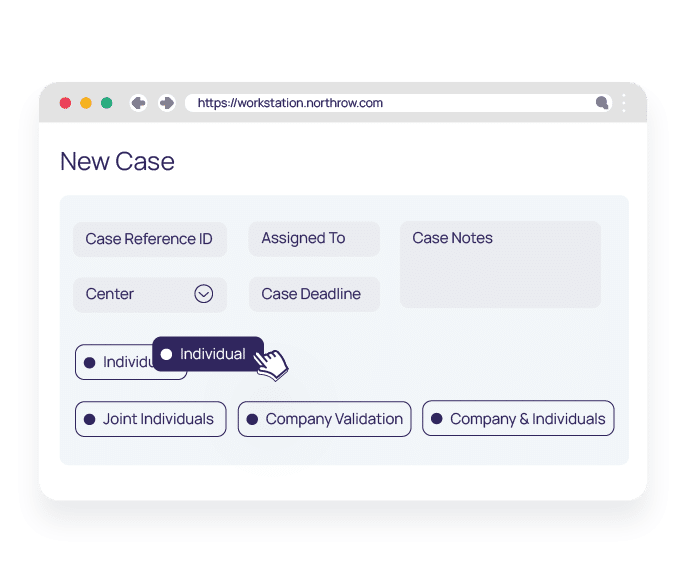

With an automated compliance platform that is easy to configure and fully flexible, you can be certain your business’ risk appetite is always being adhered to.

Software that helps you to confidently onboard customers, manage risk and compliance standards throughout the entire client lifecycle.

Grow your business safely with agile onboarding software that scales to meet the demands of seasonal changes or rapid growth.

Deliver a friction-free, enjoyable business onboarding experience for your clients in less time, at a lower cost, and with less manual effort for both parties.

Book your free demo of our comprehensive AML compliance solution today and better manage your business onboarding.

NEW

Shifting the perspective: Transforming KYB into a business enabler. Download guide today >