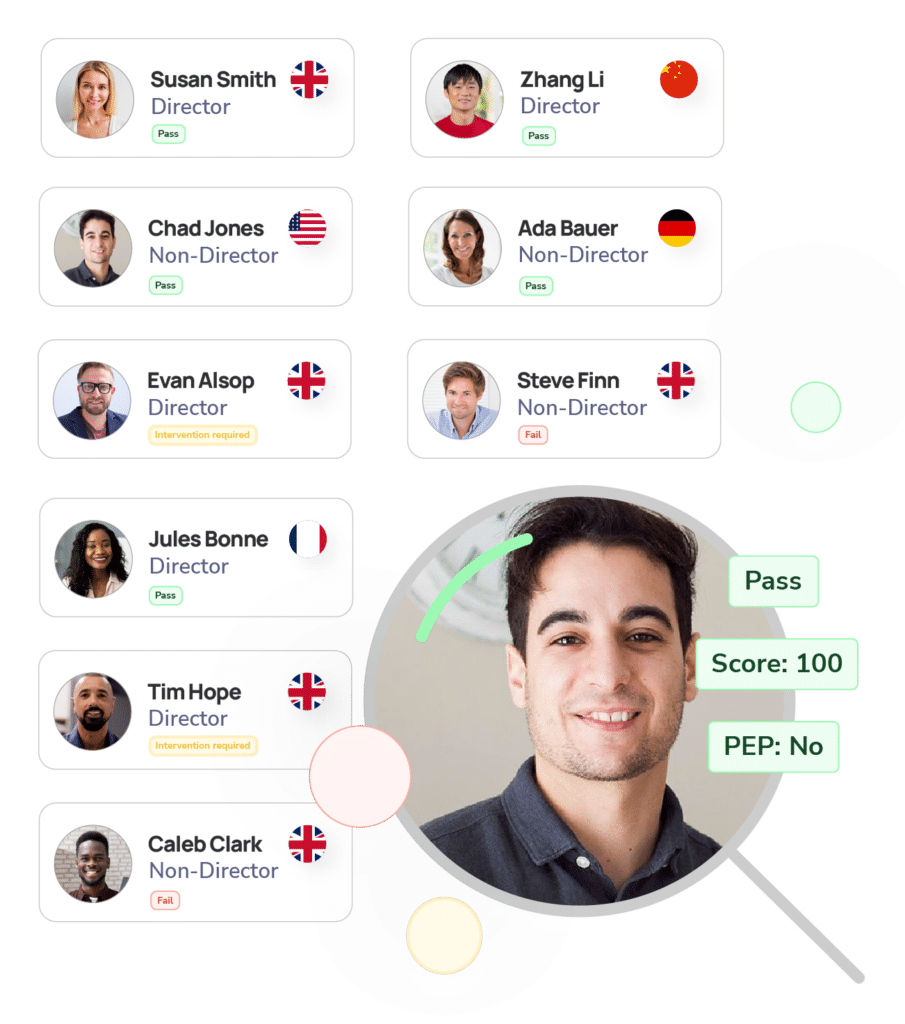

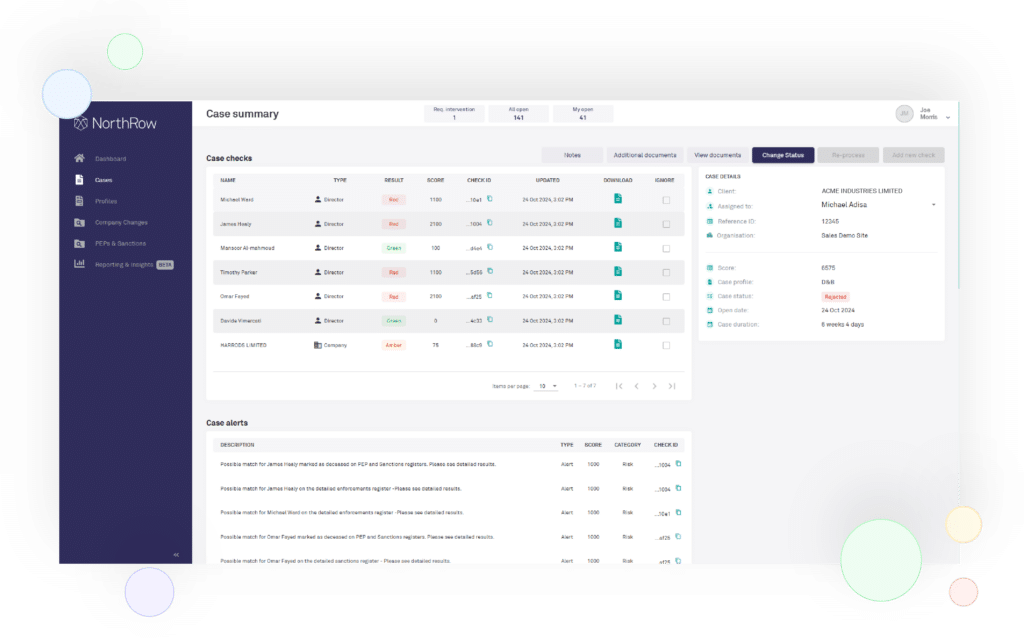

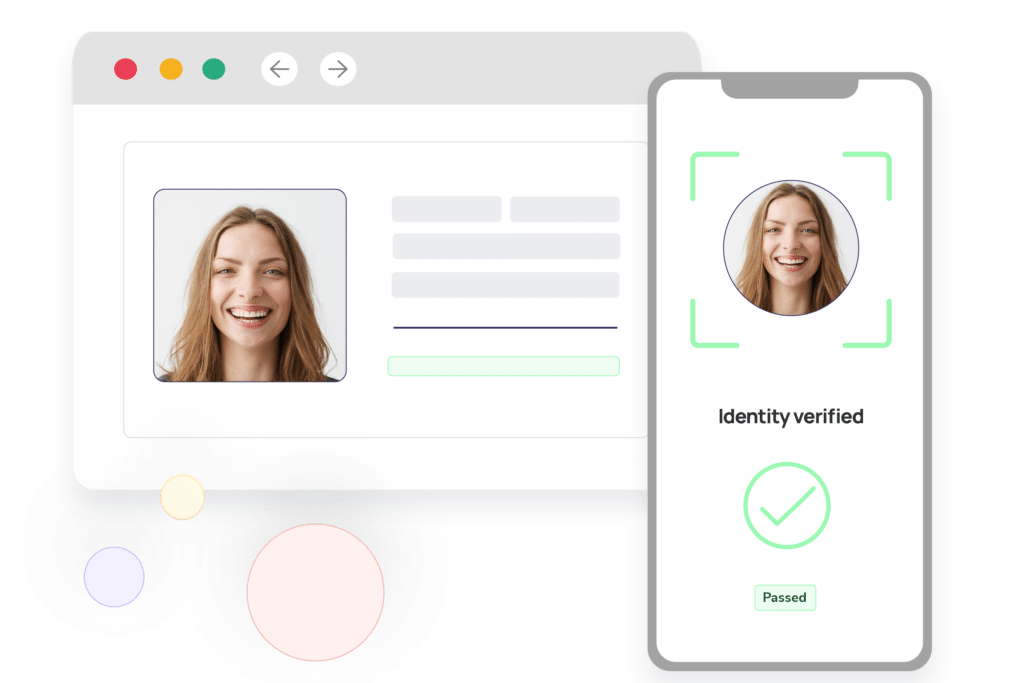

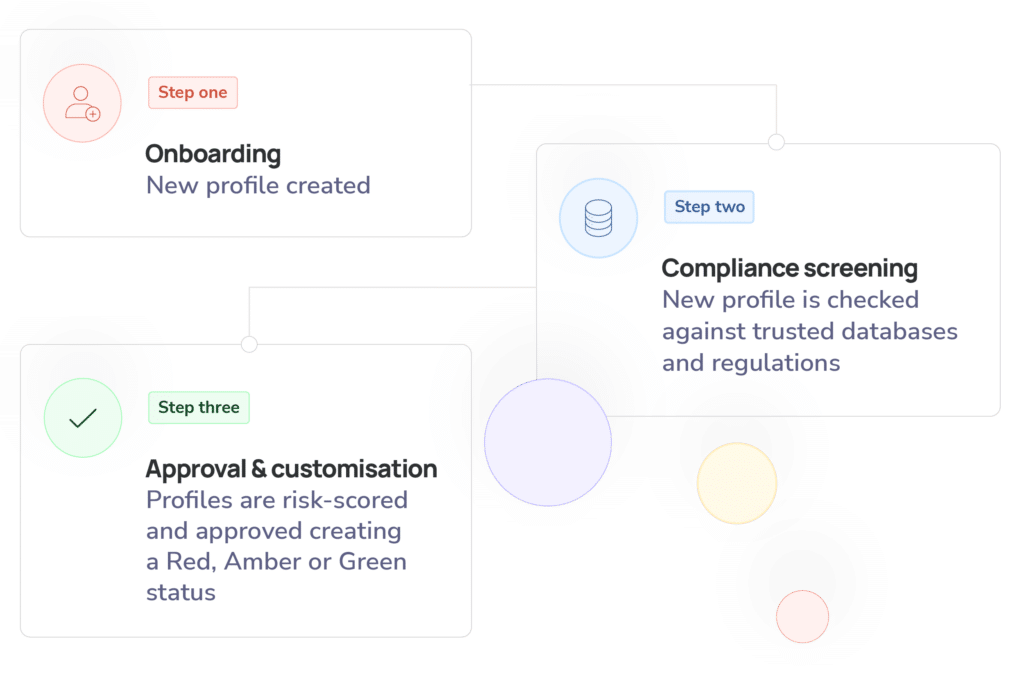

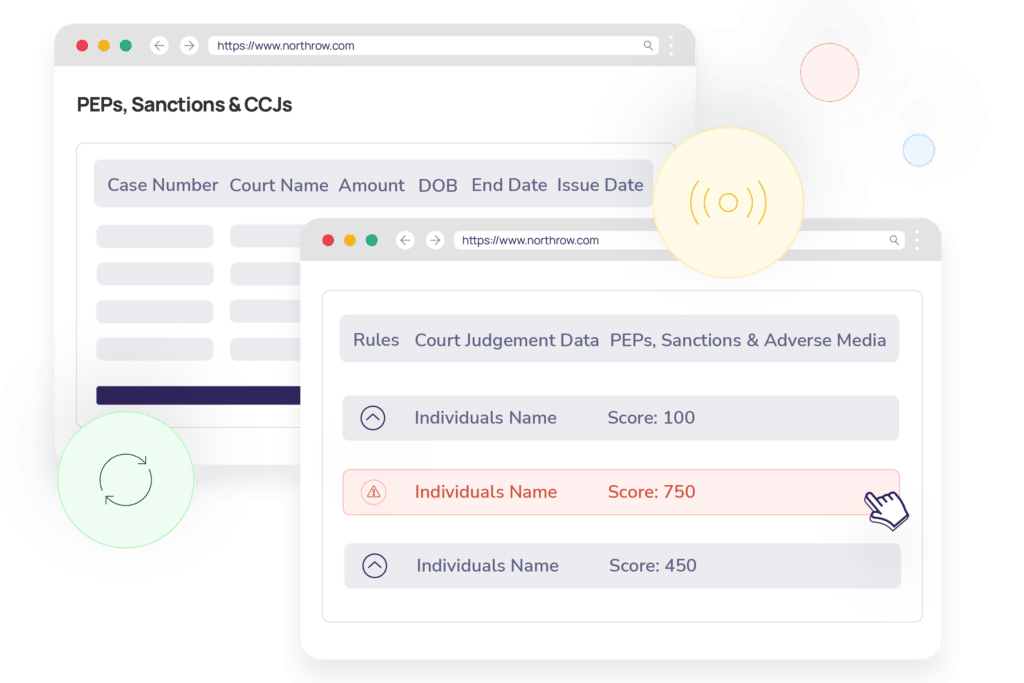

Know Your Customer (KYC) software

Automate your KYC verification for fast, compliant onboarding.

Reduce customer drop-offs by up to 130% while ensuring compliance with regulatory due diligence by offering an accurate, efficient and streamlined onboarding journey.

Request Demo

Hi 👋 let’s schedule your demo.

Tell us a bit about yourself.

“

The system efficiently and effectively completes our KYC and KYB verification requirements during onboarding.

Robin Kear

Senior Account Executive