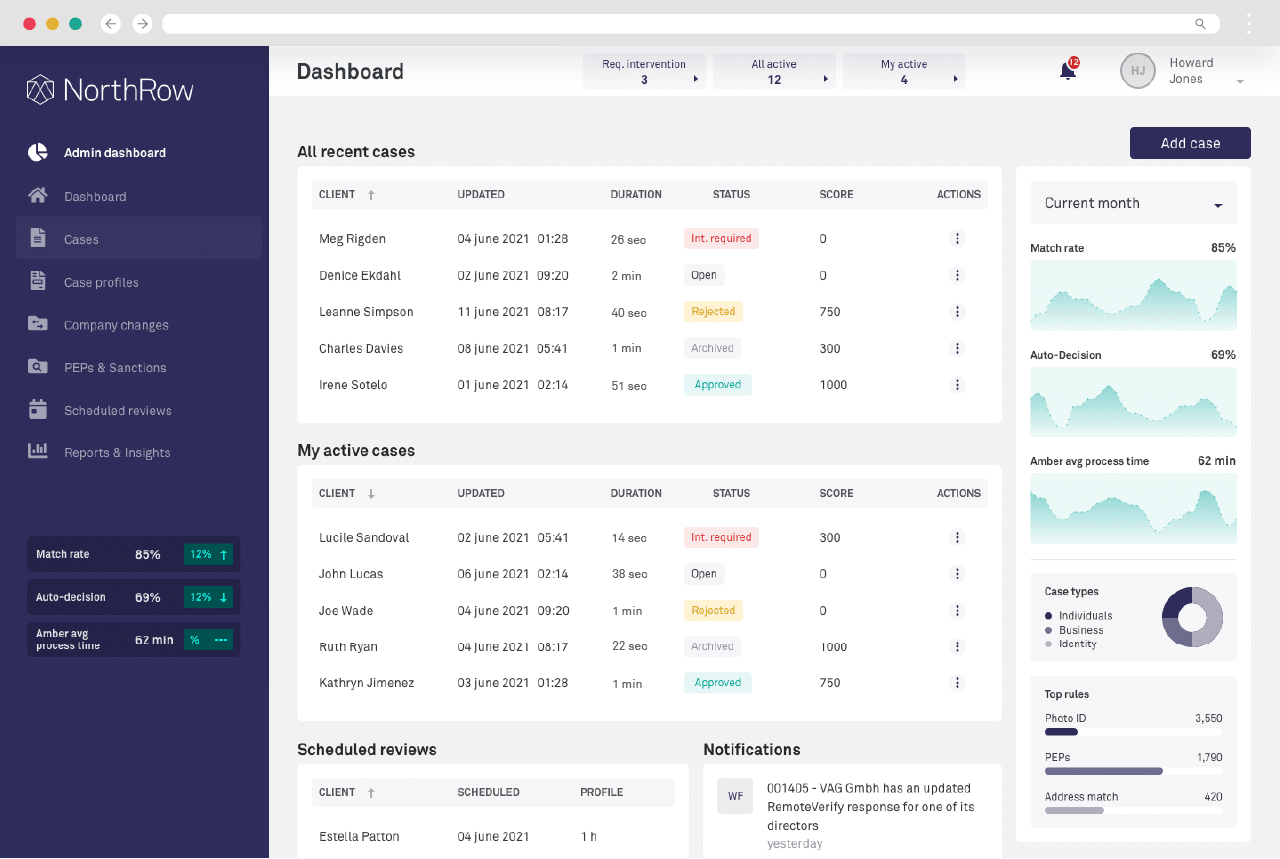

Onboard your customers in seconds, not days

Accurately vet and verify your customers with an integrated platform that automates Know Your Customer (KYC) onboarding, evaluates risk, and helps your business to ensure complete compliance with evolving regulations.

Benefits

Create a great first impression

Reduce abandonment during client onboarding and instil trust by providing a smooth, frictionless onboarding experience to your KYC checks.

Onboard more customers

Reduce the time to revenue by speeding up KYC checks and focus on growing your business, safely.

Know your customers inside out

Truly know your customers with a comprehensive KYC screening and monitoring process.

Meet AML compliance regulations

We make it easy for you to comply with the latest AML and KYC regulations when onboarding new clients.

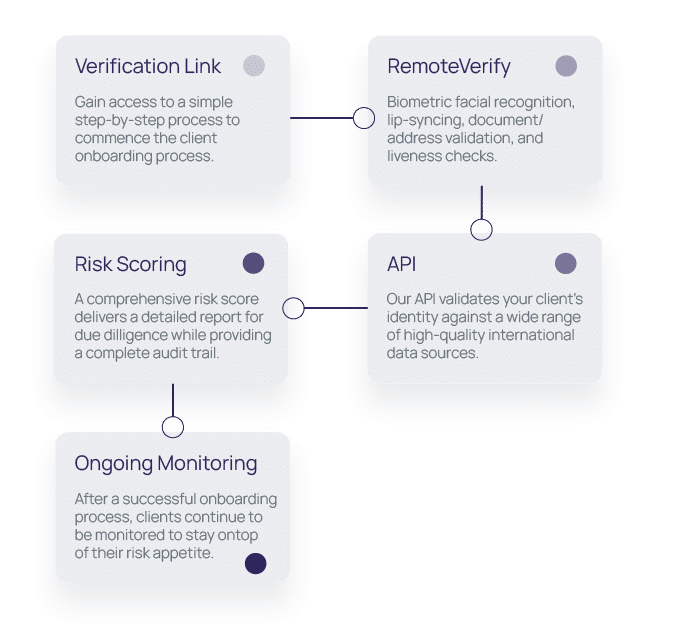

Verify

Automate identity, document and liveness verification

Ensure your customers are who they say they are with our end-to-end Know Your Customer platform that can verify identities, documentation and liveness.

Our global ID document verification platform supports the verification of over 1,700 identity documents from across 235 countries and territories.

Onboard

Save time and money with automated client onboarding

Achieve compliance and customer service goals with an effortless client onboarding process that keeps pace with any changes in regulation.

Make sure every client is onboarded following the appropriate level of scrutiny. Make use of the most common types of due diligence profile or create your own completely bespoke screening process in WorkStation from scratch.

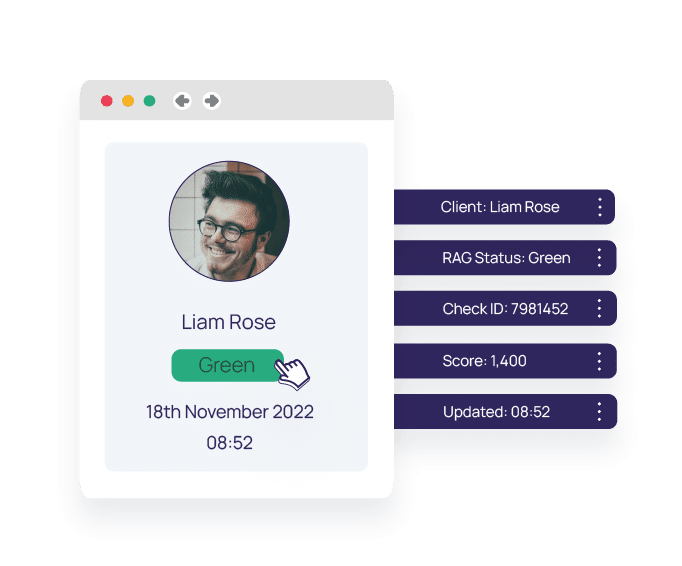

Monitor

Gain a complete picture of customer activity

Continuously monitor customers for any changes in their risk profile, including scanning them in global sanctions lists, PEP lists, and adverse media data with every KYC check.

Continuously monitor global watchlists and adverse media for any changes that may adversely impact a customer's risk profile.

Got a question?

Frequently Asked Questions

For all of your burning questions, take a look at our FAQs below. Can’t find the answer to your question? Feel free to contact us directly and we’ll be happy to help.

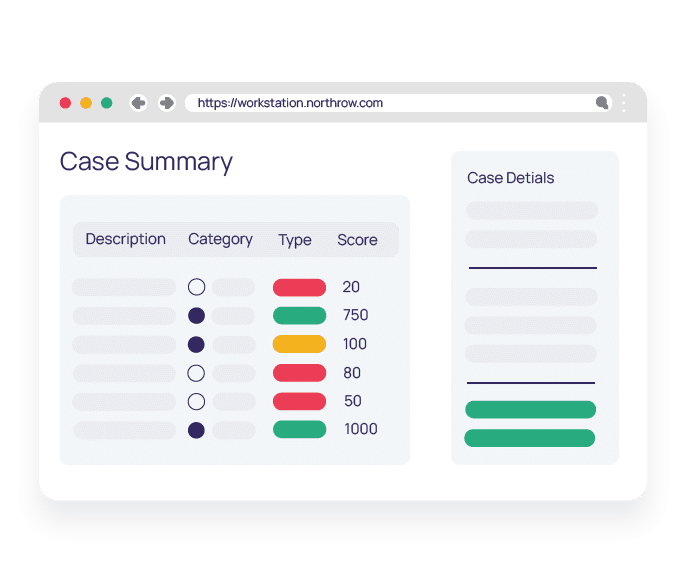

Make use of the most common types of due diligence check you’ll find below or create your own completely bespoke screening process in WorkStation from scratch.

2+2 CHECK

A traditional full KYC check, where we look for two sources of identity and address history, usually powered by a UK Credit Reference Agency (via LexisNexis). Additionally, this check might also include PEPs, Sanctions & Adverse Media screening.

RISK SCREENING

A simpler screening process including PEPs, Sanctions & Adverse Media checks configured for risk evaluation.

DOCUMENT VERIFICATION

Gather and validate identity documents provided by customers through an intuitive uploader that feeds directly into WorkStation.

REMOTEVERIFY

Allow customers to self-onboard using our intuitive ID&V platform, RemoteVerify. Customers can sign up and be verified in minutes, at their own convenience, using their own device, at any time.

Of course! We know that there is no one-size-fits-all when it comes to protecting your business from undue risk.

That’s why we designed a solution that allows users to combine any of the generic due diligence levels, as well as create completely bespoke due diligence processes by combining any of the individual check features listed.

Screen customers against global sanction and PEP watchlists including HMT, OFSI, OFAC, UN, EU and other sanctions from around the world with information updated in real-time.

Of course! WorkStation is powered by NorthRow’s powerful API, meaning that the entire platform is usable and accessible from both our intuitive user interface and via API.

We pride ourselves on being a trusted partner for hundreds of companies experiencing incredible growth. The beauty of Software-as-a-Service (SaaS) solutions like WorkStation is that we can grow with you.

Whether your compliance team is growing and you need to add extra users or increase your volume of KYC checks thanks to a boom in business; WorkStation will ensure your continued compliance without compromising on efficiency.

With WorkStation, you can maintain a comprehensive audit trail of all onboarding activities and generate detailed compliance reports effortlessly. Our software enables you to demonstrate compliance to regulators and auditors, providing transparency and accountability at every stage of the onboarding process.

“

“One of the most significant benefits of WorkStation has been the automation of our end-to-end compliance processes, allowing us to focus our efforts on high-risk cases. The software has saved us valuable time and resources.”

Joanne Miller

Hargreaves Lansdown

Balance user experiences and time to revenue

Automate your compliance processes and allow customers to self-onboard with real-time insights delivered to your compliance team to satisfy KYC and AML requirements. Removing costly manual reviews will allow you to spend more time growing your business.

Compliant onboarding

Software that helps you to confidently onboard customers, manage risk and compliance standards throughout the customer lifecycle.

Scalable

Software designed for compliance teams that is capable of scaling at speed, regardless of size, volume or the complexity of the KYC checks required.

Customer experience

Deliver a friction-free, enjoyable client onboarding experience in less time, at a lower cost and with less manual effort for both customers and compliance professionals.

Ready to get started?

Book your free demo of our comprehensive AML compliance solution today to manage your KYC checks.