In this guide, we look at four of the sure-fire signs you need to consider digitising your AML compliance processes.

Introduction

Compliance today is more complex than ever. Every day, it seems like there is a new piece of regulation or legislation that professionals need to sit up and take note of.

Today’s software solutions for regulatory AML compliance management can save your organisation thousands of pounds spent on external legal advisory services, regulatory fines, or reputational damage. There’s also the impact on increased productivity, reduced manual and human error, and a happier compliance team.

Table of contents

What is AML compliance software?

Regulated businesses have numerous legislative requirements from bodies such as the FCA and HMRC, notwithstanding the legislation in their respective industries.

Despite the sheer volume of new legislation and frequency of regulatory change, many companies continue to rely on external legal counsel, or internal legal teams to interpret their regulatory requirements. And for good reason. Legislative requirements are often delivered in a document that would give War and Peace a run for its money! They’re chock full of legal jargon and make interpretation a challenge unto itself.

Those that don’t outsource often rely on time-consuming, manual processes. Thumbing through endless pages and lists of requirements and obligations; often with talented compliance professionals spending hours interpreting even the smallest of regulatory updates.

In 2018, it was estimated that British financial institutions were spending £5 billion every year fighting financial crime and preventing money being laundered through their network of bank accounts.

Wired

Achieving compliance manually is 100% achievable and businesses today can be compliant without the use of, or at least very little, technology. They have a process that works for them and often have a good relationship with the regulators. Making the leap to adopt technology and bring it into an infrastructure that already ‘works’ can be daunting.

As compliance professionals, they have a personal responsibility to make sure their organisations are, and continue to be, compliant with the necessary regulation. And yet, compliance software does not need to be feared. Nor does it replace the need for a compliance team, adversely impact your compliance efforts or negate the existing, strong relationships you may have with the regulators.

Like any piece of tech, it simply enables you and your team to work smarter…not harder.

#1

An increasing workload is slowing growth

An increasingly unmanageable workload can be a significant barrier to better performance, workplace happiness and overall motivation. It is often the case that most of us look towards tech to help with scalability and consistency in processes.

Feeling like you can’t see the wood for the trees can lead to bottlenecks in your compliance processes and, ultimately lead to a poor customer experience. With employees working remotely already feeling under pressure to work beyond their normal hours, the threat of employee burnout is a very real one.

And yet, the size of compliance professionals’ workloads is not going anywhere and in cases where department budgets are not growing, teams are struggling to get the work done, and subsequently hiring more employees or losing efficiency. In a recent study carried out by global data provider, Dun & Bradstreet, almost half (49%) of compliance professionals in the UK financial sector surveyed believe that it will become harder for their organisation to comply with financial regulation over the next twelve months.

As regulation across entire industries evolves in complexity, ensuring compliance will only hinder the onboarding processes and damage customer experience.

Two fifths (40%) of compliance professionals expect customer onboarding times to increase over the next five years.

Dun & Bradstreet

HOW CAN TECHNOLOGY HELP?

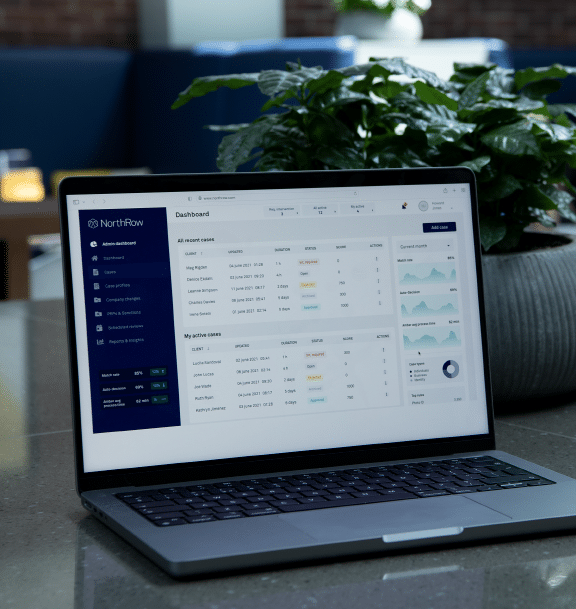

Technology can deliver even the most overworked compliance teams with flexibility and can lead to greater efficiency. Using modern compliance software, straightforward cases will be assigned a simple ‘Yes’ or ‘No’ decision based upon your business’ pre-defined risk profile and requirements – without the need for manual intervention or further involvement.

Naturally, there will always be cases that require further due diligence before you safely commit to onboarding them, or continue an ongoing relationship with the customer, or not. It is these cases which often result in a higher proportion of manual activity and intervention required.

Here at NorthRow, this is what we call ‘Amber Management’ and is often where the vast amount of compliance costs stem from. It is estimated that a staggering 90% of compliance costs sit within just 10% of cases!

Our clients can customise their own risk profile within the system depending on what they perceive as being high/low risk in their business. Of course, every business will have its own meaning of what high or low risk looks like in terms of carrying out CDD.

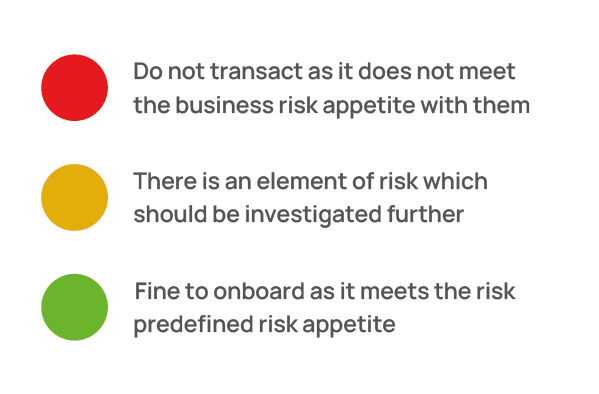

Depending on these risk factors, the system will return an ‘auto-decision’ via our associated RAG system (Red, Amber, Green) to denote whether you can safely do business with a customer or not and instead requires further due diligence.

#2

AML compliance is causing delays in onboarding new customers

We live in a world of instant gratification. For clients signing up to, or purchasing your products or services, they usually want them now.

While, undoubtedly, client verification is critical in regulated industries for products such as mortgages, credit cards and bank accounts; they are also crucial for firms offering financial services, selling property or high value art dealers. Regulated sectors, including financial institutions like banks, are required by law to conduct customer due diligence (CDD) to ascertain if they represent a legal or financial risk, and by extension to the global financial system.

Where AML checks are required, firms need to be able to confidently verify the identity of their client, screen them against global PEP and Sanctions lists instantly and ensure that there is no risk of financial crime such as Money Laundering.

But, all too often, where these checks are carried out as part of onboarding the customer, they can take days to return results, frustrate the customer with a poor user experience and, ultimately, delay the time to revenue or cause higher abandonment rates.

Firms develop comprehensive onboarding processes to meet requirements based on the jurisdictions they operate within. The risk of fines, reputational damage and costly corrective actions to remediate any gaps identified by regulators is often the cornerstone of these onboarding processes – they are developed to satisfy their legal requirements and inspections from regulators or auditors.

40% of consumers abandon retail bank on-boarding process when applying for a new product or service.

Signicat

Little focus is given to the actual customer onboarding experience due to the pressure from regulators seeking to identify deficiencies in their processes. The focus is often on satisfying the regulator, not on the customer.

Despite being the crucial first step a firm goes through when acquiring new customers, a poor KYC onboarding experience can directly, and negatively, impact the customer experience, with adverse effects on a firm’s bottom line. Moreover, firms must ensure ongoing KYC throughout their relationship with a client and businesses continuously update customer information as a part of their risk management strategy.

Out-dated ID and verification systems, lengthy turnaround times and endless requests for documents and personal information will only stand to frustrate the customer and, especially in today’s security-savvy world, cause undue concern for some clients about how their data is being collected, used and stored. According to a study conducted by Forrester, customers were contacted on average 10 times during the onboarding process and asked to submit between five and up to 100 documents!

HOW CAN TECHNOLOGY HELP?

Financial services organisations and regulated businesses are under pressure to deliver a great customer experience while managing costs, risks, and compliance – all in an industry that is continuing to rapidly change and evolve.

Using clunky manual processes to gather all the necessary data to perform anti-money laundering (AML) and know your customer (KYC) checks can create complexities and long processing times, impacting the overall experience for customers and employees.

Speed

Today's customers expect a fast, efficient onboarding process.

Convenience

One they can complete at their own pace, at a time that suits them.

Digital KYC onboarding

Using their own device to prove their identity and access products.

Using compliance technology, firms can automate the checking of, for instance, customers’ address history, credit history and criminal convictions. This information enables companies to know their customers better and prevent fraudulent activities – without the lengthy delays associated with a manual checking process.

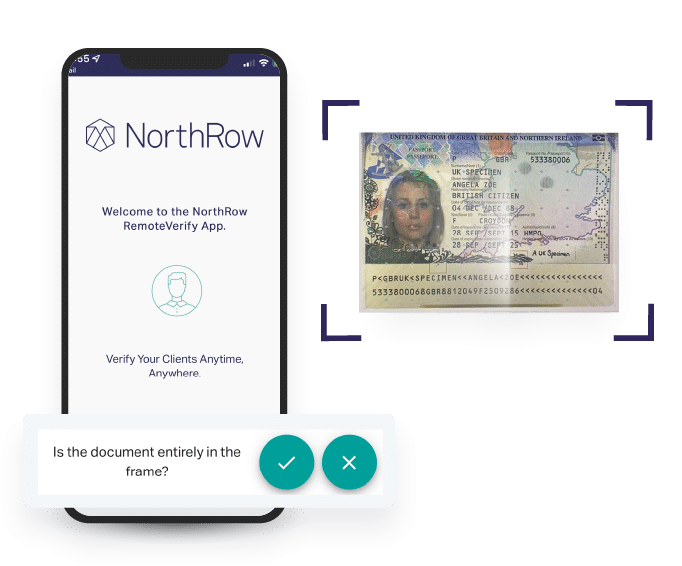

Equally, using comprehensive KYC technology in conjunction with ID&V software can offer capabilities for customers to self-serve KYC requests such as uploading documents digitally and verifying their identity through liveness checks using just a device with a camera.

The software will return swift decisions for whether to progress the onboarding of this client or not, or whether further information is required via manual intervention to resolve any KYC discrepancies.

Using compliance technology will save valuable time checking or verifying physical documentation and provide firms the opportunity to add value elsewhere to the client.

Outdated, paper-based processes that take weeks to complete will only stand to cause frustration with your firm and lead to standing out for all the wrong reasons.

Without integrating modern technology, firms will lose their competitive edge and, more importantly, may lose customers to competitors with easier to use technology during the onboarding process.

As new buyers become customers, smooth onboarding should be a top priority to set the stage for value achievement, retention and growth. A smooth onboarding process for new customers has a direct impact on product adoption, product usage, achievement of value, customer retention, and the creation of opportunities for growth and advocacy.

Forrester

#3

Manual AML compliance is becoming time-consuming

With anti-money laundering regulations constantly evolving, staying on top of the necessary AML requirements is a complex and time-consuming process.

These often involve compliance teams manually searching company records, thumbing through case files, chasing down documents from Ultimate Beneficial Owners (UBOs), and verifying endless pages of company accounts and financial statements, which can ultimately stretch the department’s resources. Depending on the jurisdiction, there are often different requirements on how information can be collected for AML checks, and official registries from across the globe may be in varying states of comprehensiveness; ultimately making it increasingly difficult for compliance professionals to verify and onboard businesses quickly when relying on manual processes.

What’s more, manual AML searches often rely on physical documentation being available – but these documents are vulnerable to forgery, and manipulation.

HOW CAN TECHNOLOGY HELP?

Fortunately, software can now help compliance teams to alleviate much of the heavy lifting associated with compliance checks, freeing them up to focus on more complex cases where their expertise is most needed.

The software automates the verification of company entities, company directors and beneficial owners in-real time. It can authenticate individuals, identify PEPs and cross-reference against known sanctions lists – all in a matter of clicks.

Considering the volume of information now required to satisfy AML requirements, carrying out this level of research manually would take days. And that is just for one case!

At NorthRow, our data sources span 220+ countries and are readily accessible within one single platform. This entirely eliminates the need for multiple licences,

accounts and invoices from a myriad of suppliers; meaning that compliance teams can get the information they need in minutes.

Armed with modern technology, compliance officers can make faster decisions and onboard customers in seconds, not days, so that they can continue to actively contribute to the ongoing growth and success of their business.

#4

Compliance shortcuts are putting your reputation at risk

In cases where businesses are overly risk-averse or, if there is a backlog of cases awaiting compliance checks, customer-facing teams may take to seeking out ways to ‘smuggle’ unverified clients through loopholes in your compliance processes.

Compliance teams will be coming under increasing pressure to speed customer cases up and arrive at an onboarding decision, especially in sectors where a commission payment is involved (such as in the property sector) for closed deals.

For those not ‘in the know’, due diligence is sometimes thought of as a tick-box exercise, but it is imperative that everyone within a firm that is involved in onboarding and managing customers sees it as a critical activity and maintains ongoing client monitoring.

Often, the proper checks have not been performed simply because an employee at a firm ‘knows’ the client: this is identification rather than verification, and there is a big difference between the two. Delays in compliance can tempt customer-facing teams to take shortcuts in the compliance process to acquire a new customer quickly and get them on the books, but this is a false economy in the long run.

Not only does this open up entire businesses to undue risk of fines and reputational damage, but creates a disconnect between teams working towards a common goal and further compounds the perception that compliance teams are seen as a blocker to onboarding clients. This is often due to the sheer scale of compliance teams’ workloads, and the time that thorough KYC/B checks can take when being performed manually.

HOW CAN TECHNOLOGY HELP?

When implemented correctly, compliance technology can play a significant role in improving KYC and AML processes. Crucially, the software can accomplish the steps necessary for compliance far quicker than is possible manually.

This involves gathering information from around the world, analysing it and running it through screening, gathering adverse news on clients, and finally bringing it all together, with less human oversight and saving further time for compliance teams to focus on the cases where intervention is most needed. Just some of the key benefits of digital AML compliance are below:

Speed

Today's customers expect a fast, efficient onboarding process.

Convenience

One they can complete at their own pace, at a time that suits them.

Digital KYC onboarding

Using their own device to prove their identity and access products.

With a system that returns ‘Yes’ or ‘No’ onboarding decisions in a matter of minutes, more attention can be paid to the cases where a professional’s expertise is required. Here at NorthRow, we call this process our RAG system: Red, Amber or Green. This is based entirely on a company’s unique risk appetite and is defined ahead of carrying out any compliance checks or verification.

The strategy for dealing with Red records should be clearly laid out and swiftly performed together with the Greens. But, if anything, greater attention needs to be given to the Amber records, as these will either move into Red or Green depending on the outcome of your investigations.

Ready to get started?

Book your free demo of our comprehensive AML compliance solution today.