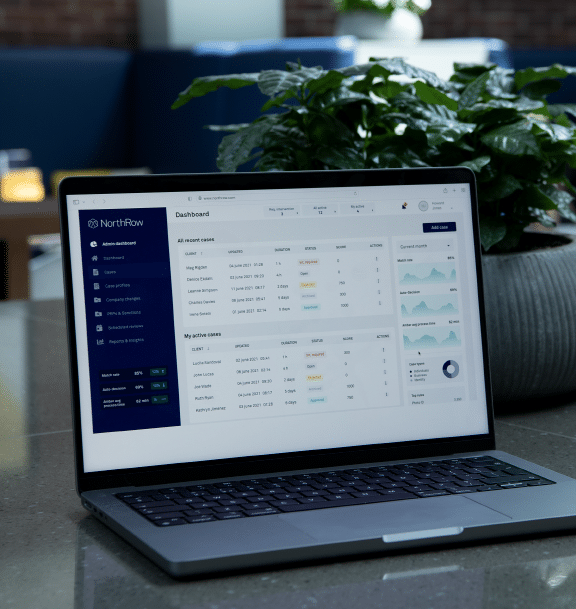

About NorthRow

Making it our business to protect yours.

Hi, we’re NorthRow 👋

Request Demo

Hi 👋 let’s schedule your demo.

Tell us a bit about yourself.

“

The system efficiently and effectively completes our KYC and KYB verification requirements during onboarding.

Robin Kear

Senior Account Executive