Know Your Customer (KYC) Software

KYC software to instantly verify customers worldwide

- Verify identities in seconds for faster onboarding

- Authenticate ID documents from 200+ countries

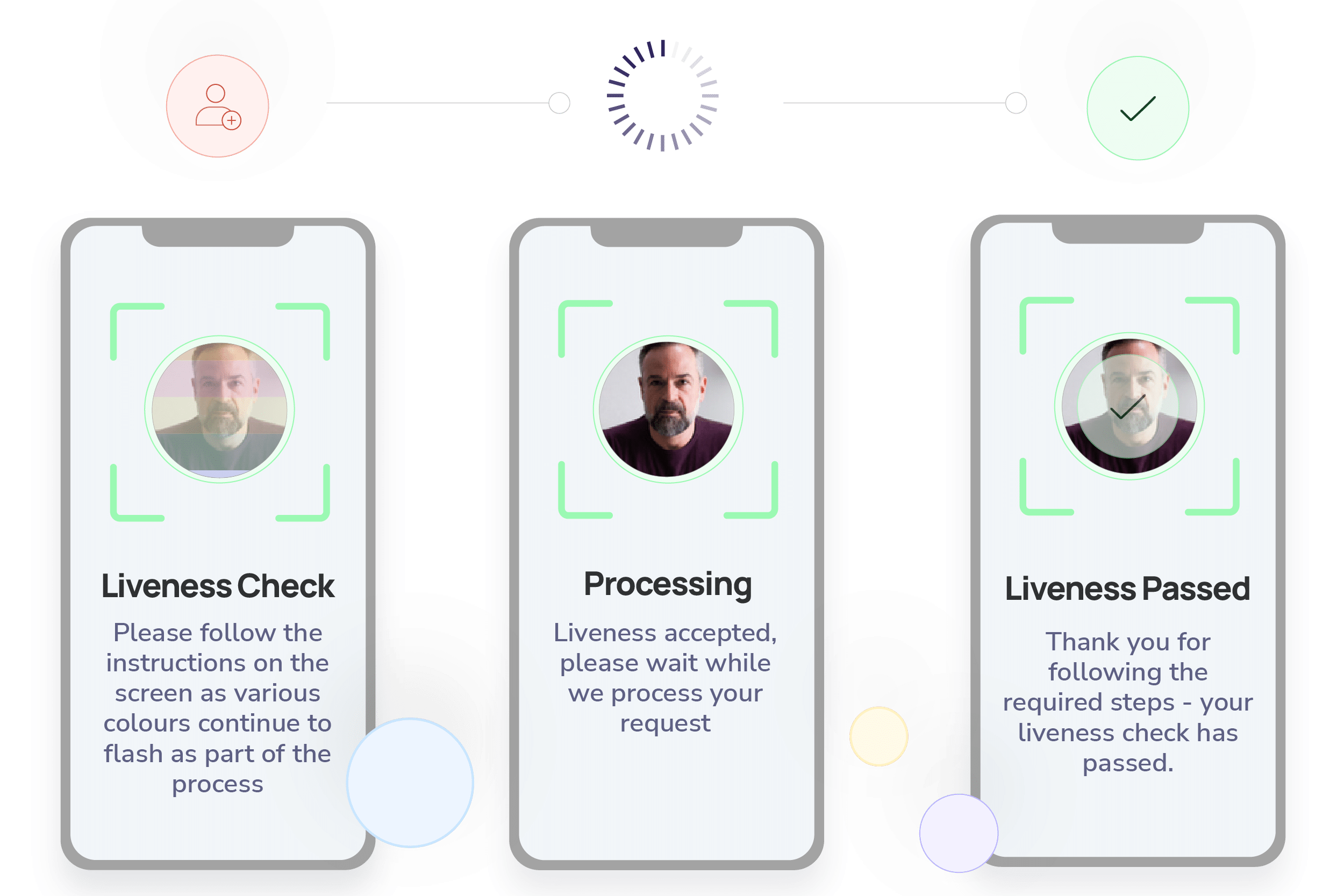

- Liveness and biometrics checks to prevent fraud

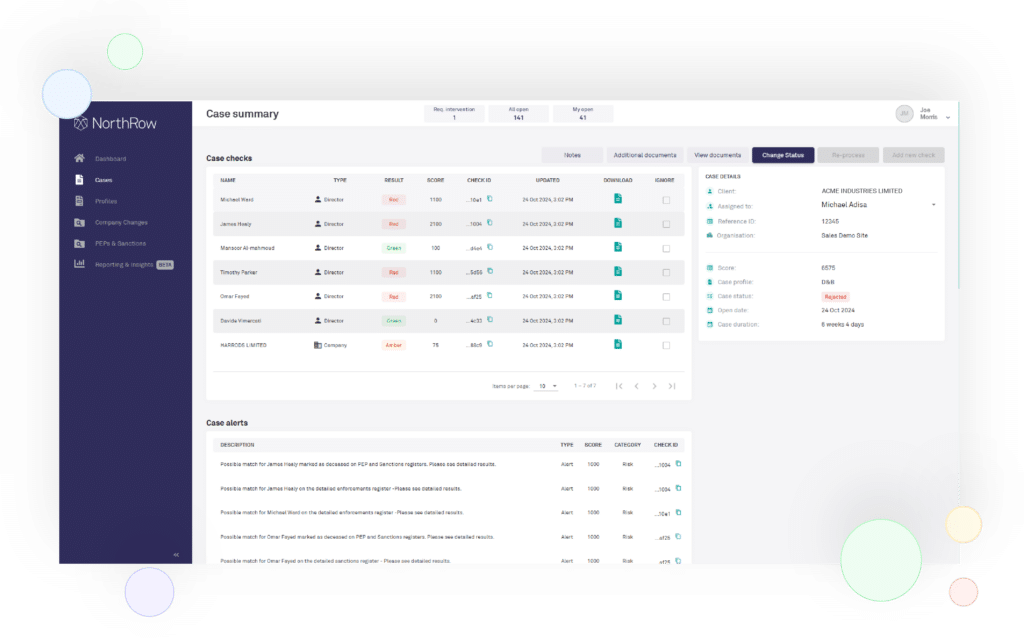

- Screen against global PEPs, sanctions, and watchlists

- Meet AML compliance requirements with a full audit trail