Automated AML compliance and screening

Our AML compliance platforms include KYC, KYB and ID&V, empowering you to make faster decisions and onboard customers in seconds, not days, while complying with ever-changing legislation and combatting financial crime.

Trusted by hundreds of companies to digitally transform their compliance processes.

Rated 4.5 out of 5

Get started today

Complete the form to request your demo

What we offer

End-to-end solution to meet compliance regulations

Oversee and streamline AML compliance processes throughout the customer lifecycle, digitally transforming the fight against financial crime and fraud, while creating modern customer experiences that foster satisfaction and loyalty.

Onboard

Automate identity, document and liveness verification

Onboard individuals and businesses with ease with our integrated AML compliance platform that automates verification, evaluates risk, and simplifies compliance with evolving regulations.

Monitor

Alerts to any counterparty risk profile changes

Understand any risk profile changes to both companies and individuals, so you can keep tabs on political exposure, sanctions or adverse media and ensure you remain compliant.

Remediate

Re-assess your customer data and rectify any issues

Update back-books of customer data with ease to ensure it remains accurate and at the relevant risk level to meet your company's risk profile and current regulation.

How we help

Flexible and modular RegTech architecture

Choose the suite of tools you need, when you need them and digitise your AML compliance processes in a flexible way that matches your business’ needs and timeline.

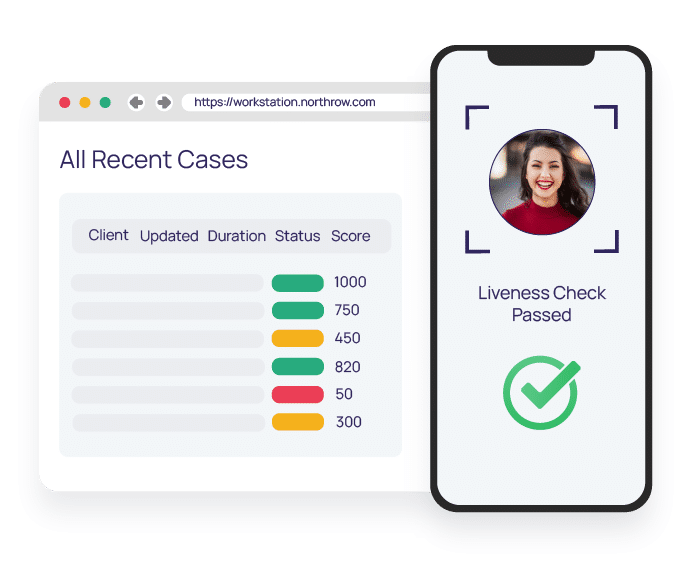

KYC and KYB Screening

Conduct comprehensive AML screening on individuals and business.

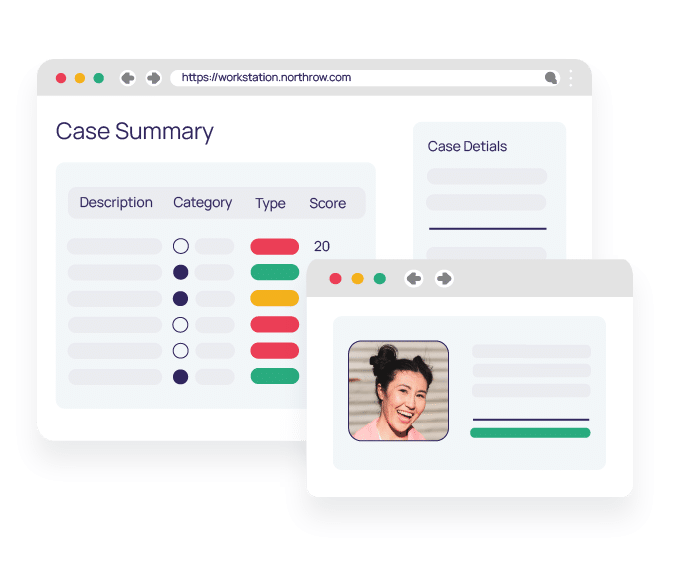

Case management solution

Group checks into easy-access cases with a risk rating for each portfolio.

ID&V

Carry out comprehensive identity and document verification checks remotely.

AML compliance

Keep track of potential risks to ensure ongoing AML compliance.

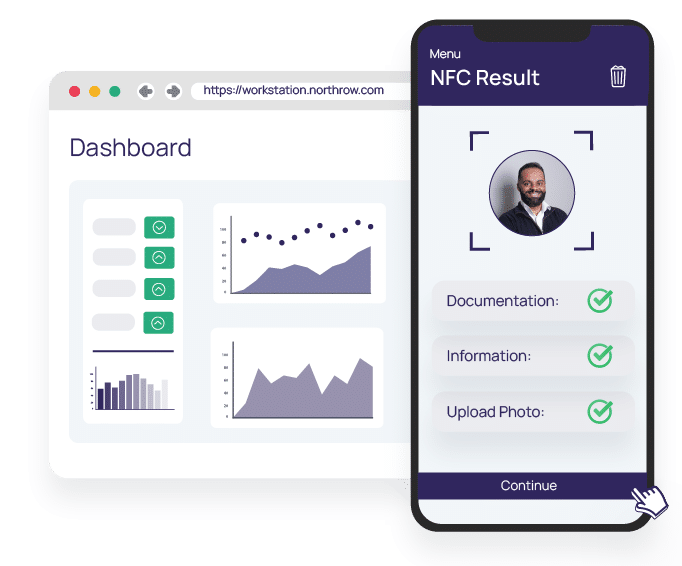

Ongoing monitoring

Automated alerts notify you of any risk profile changes to both companies and individuals.

Remediation

Meet your KYC obligations and be confident that your customer data is up-to-date.

“

“NorthRow has been very easy to work with; they have listened, and their approach is professional, transparent and consultative. Their ability to deliver a bespoke AML solution that combines automated identity checks with the added security of face-to-face verification made them the obvious choice.”

Nigel Spencer

Open Banking

Leading Data Providers

Global individual and company data coverage

Donec luctus, risus a ornare ultrices, lacus ligula pellentesque massa, sit amet elementum velit libero ac ipsum. Nulla facilisi. Morbi nec mattis interdum augue nulla.

1000s

Users globally

250,000+

AML checks every year

98%

Match rate

95%

Auto-decision rate

Got a question?

Frequently Asked Questions

Aliquam interdum risus vitae lectus convallis sodales quis dignissim mi. Proin sem risus, aliquet in pretium eu, ultrices eu nibh. Sed eu metus mollis, fringilla ligula quis.

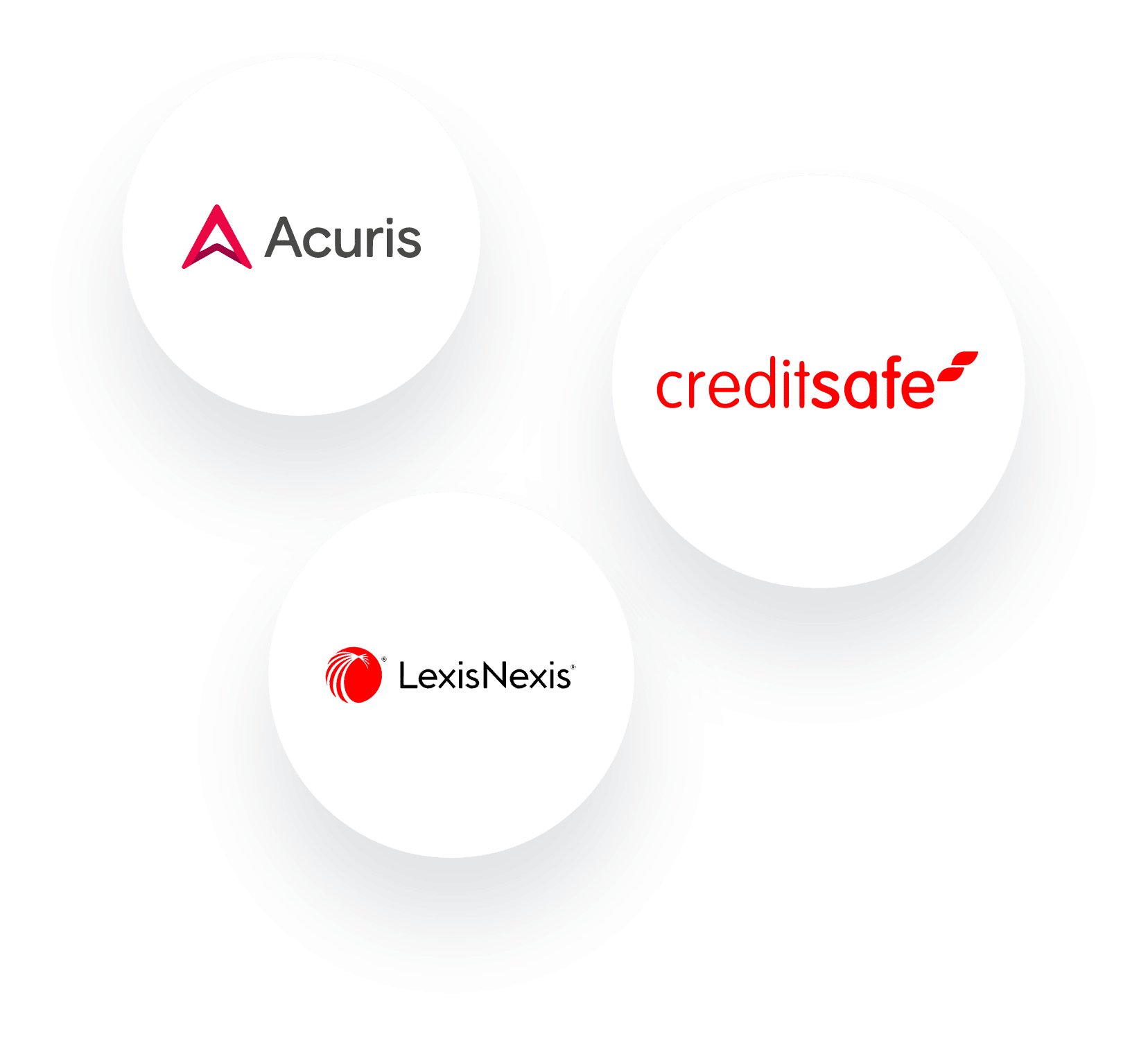

At present, NorthRow has a number of key data providers that it is closely coupled too. These three suppliers are used in over 90% of checks undertaken within the system.

Lexis Nexis is our core provider of UK identity and address validation data, such as credit reference agency & electoral register data.

Acuris (often referred to as C6), is our core provider of Risk data, specifically PEPs, Sanctions & Adverse media data, which is one of the most important factors our platform checks, and is used in the majority of checks within the platform.

Creditsafe is our supplier for company data. Whenever a customer looks up a company within our system, the data about that business is provided by Creditsafe

At NorthRow we take security very seriously, we adhere to the highest, rigorous standards for data, privacy and security compliance. The data you send us is only used to verify your client’s identities and businesses. We never use it for any other purpose. We send it to third parties to complete the checks, and we can share our list of sub-processors with you so that you have full transparency of how your data is used.

Our products are tested continuously throughout our development process by a team of internal QA engineers. In addition to the application testing we regularly scan for vulnerabilities using third party services and undertake annual detailed penetration testing. We continually monitor new vulnerabilities and proactively work to ensure that we are protected.

We host our services within the EU on Amazon Web Services. The data is encrypted in transit and at rest using AES-256 keys. Almost all of our sub-processors are also hosted within the EU. However, we will advise you if you need a service that is not based in the EU.

NorthRow makes use of the Amazon Web Services and Microsoft Azure to ensure we do not have a single point of failure in our architecture. All the data we hold and the services we provide are backed up at regular intervals to protect against disruption or loss of data.

From the moment we work together, we hold your hand throughout the implementation process and continue through to ‘go live’.

Excellent customer service and continued support are all part of partnering with NorthRow. You can always email our support team at support@northrow.com if you have any queries.

All customers receive a dedicated account manager who will keep in touch to ensure you get the most out of our software.

Typically, we get our clients live within 14 days of them signing a contract.

What we do →

Understand how NorthRow can help you confidently onboard customers, manage risk and be compliant.

Why NorthRow →

How NorthRow ensures continued AML compliance in the most automated, efficient and accurate way possible.