UBO stands for Ultimate Beneficial Owner. It refers to the person (or persons) who ultimately owns or controls a company or legal entity. The UBO is the individual who enjoys the benefits of ownership, such as receiving profits or exercising control over decision-making, even if the ownership is held through a chain of intermediaries or complex corporate structures. Depending on the jurisdiction, someone may be defined as a UBO if they own a substantial part of a company (e.g., 10-25%) and have voting rights.

Identifying the UBO is crucial for various reasons, including transparency, anti-money laundering efforts, and combatting fraud. Identifying the UBO also helps prevent the misuse of legal entities for illicit purposes and promotes accountability and integrity in business transactions. Verifying Ultimate Beneficial Owners typically involves gathering information about individuals who own or control a company, a process that can often be complex and time-consuming – especially if done manually.

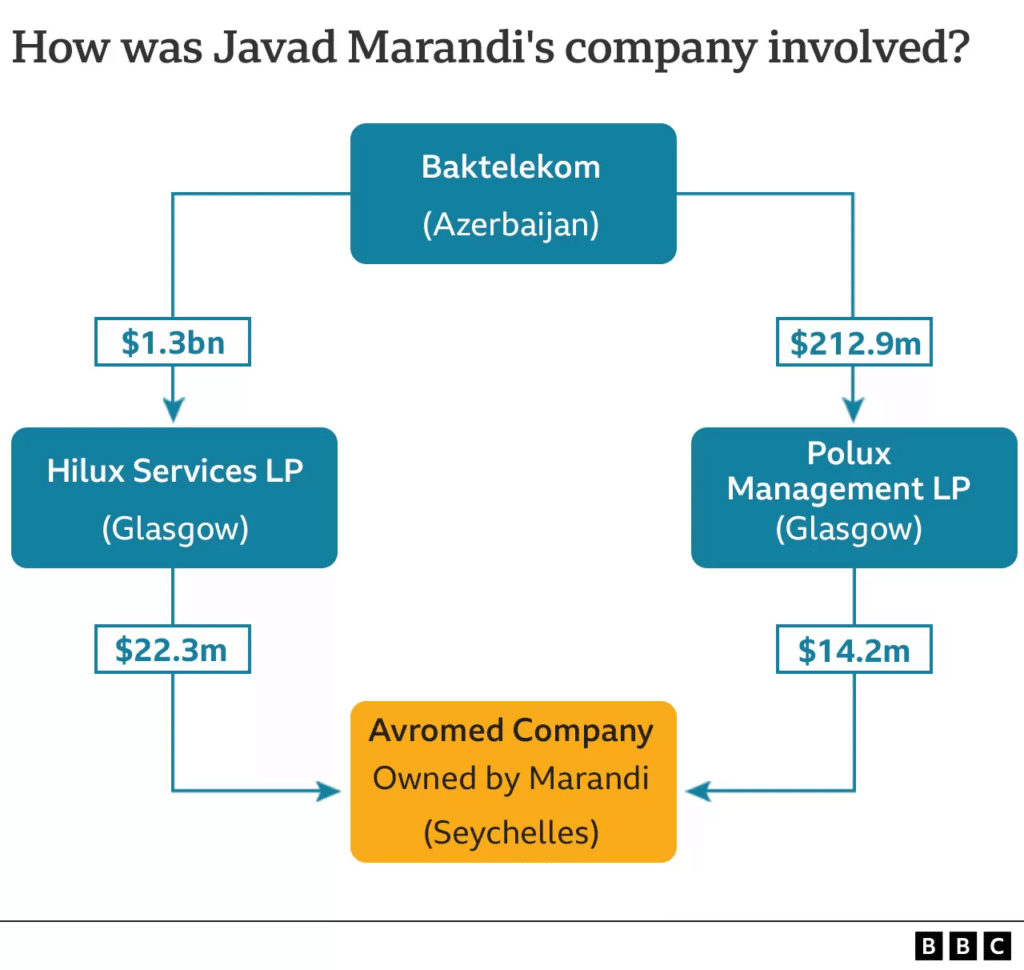

The importance of identifying UBOs when onboarding new customers cannot be stressed enough. A recent case highlights this, involving Javad Marandi – a Tory donor who was involved in funding a money laundering ring in Azerbaijan with illegitimate funds being moved through companies where he was the beneficiary. The elaborate money-laundering scheme involving one of Azerbaijan’s wealthiest oligarchs was uncovered by an investigation carried out by the National Crime Agency (NCA). The NCA discovered that certain overseas interests belonging to Mr. Marandi were instrumental in this scheme. In January 2022, a judge authorised the NCA to confiscate £5.6 million ($7 million) from the London-based family of Javanshir Feyziyev, who is a member of Azerbaijan’s parliament.

How to identify and verify UBOs with KYB/KYC

To identify a UBO, companies need to implement KYB (Know Your Business) and KYC (Know Your Customer) processes, which includes establishing a proper Customer Due Diligence (CDD) procedure. This is the process of collecting, verifying, and monitoring information provided by customers.

KYC and KYB processes are typically used by financial institutions and other regulated entities to verify the identity of their customers (whether individuals or businesses), including the UBOs of organisations. While KYB & KYC procedures can vary, here are the general steps to finding and verifying a UBO:

Obtain relevant documents: Request the necessary documents from the customer or business, such as company formation documents, shareholder registers, articles of association, and any other legally required filings.

Review ownership structure: Examine the provided documents to understand the ownership structure of the company, look for details on shareholders, directors, and any intermediate entities that may be involved.

Identify significant shareholders: Determine the shareholders with significant ownership stakes. This may involve identifying those with a certain percentage threshold of shares or voting rights, as defined by regulatory requirements or internal policies.

Request UBO information: Obtain information on the individuals who are deemed to be UBOs based on the ownership structure and ownership thresholds. This typically involves collecting details such as full name, date of birth, residential address, nationality, and any other required information.

Validate UBO information: Verify the provided UBO information through reliable sources. This may involve cross-checking the information against public records, government databases, or other trusted sources to ensure accuracy and authenticity.

Enhanced Due Diligence (EDD): In some cases, when dealing with high-risk customers or complex ownership structures, additional due diligence measures may be necessary. This could include conducting more extensive research, engaging third-party providers, or using specialised tools to gather more in-depth information about the UBOs.

Ongoing monitoring: Checks must be continuous as there’s always a chance that a customer’s profile changes over time, for example, a UBO could be sanctioned or involved in high-risk transactions, or simply make changes to their personal information.

Using NorthRow to verify UBOs

For many organisations, getting the details of UBOs is not straightforward. Typically, many compliance technology firms provide complex corporate webs that map out all the companies associated with an individual. These tend to be confusing and can take hours or days to manually identify attributes such as company name, address and registration details.

NorthRow’s solution allows you to uncover Ultimate Beneficial Owners and company directors anywhere in the world, at any time. Our market-leading self-service solutions enable compliance professionals to unravel complex corporate structures to identify and Ultimate Beneficial Owners, and verify their identities using a progressive web app. The progressive web app will then take the UBO through the steps of identity verification, document verification, liveness checks and address verification, streamlining your business onboarding process.

If you would like to learn more about simplifying Beneficial Ownership with NorthRow, please book a free demo to find out more about our identification tool.