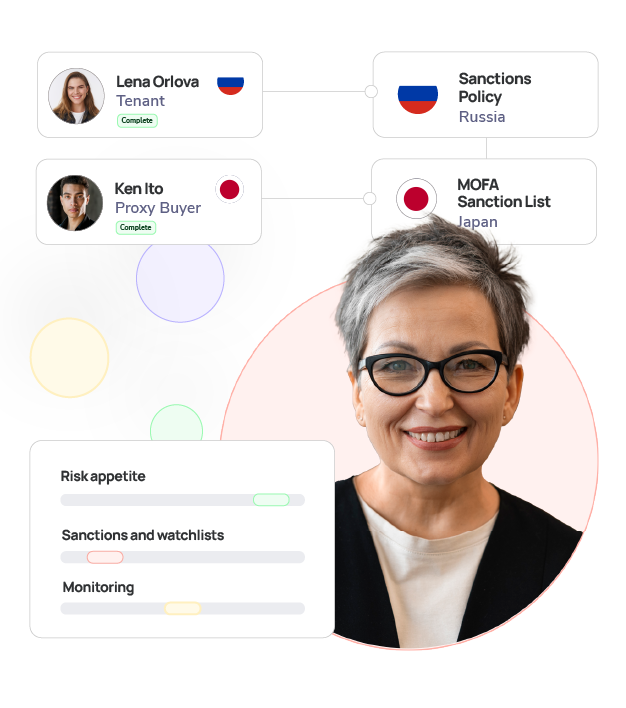

Tenant assurance for property

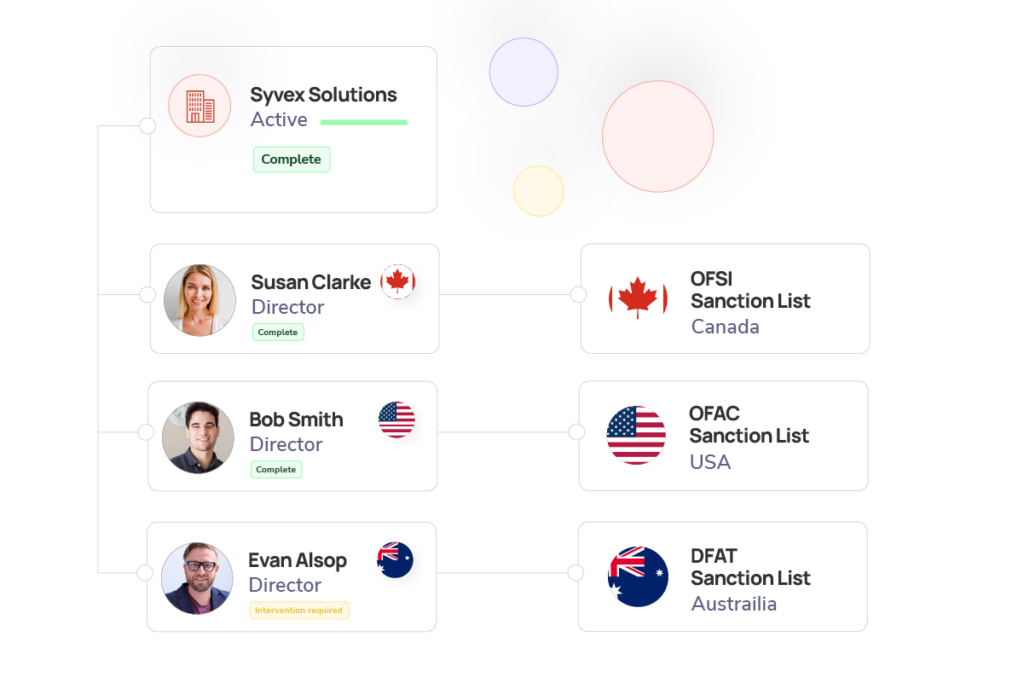

Identify ultimate beneficial owners while mitigating fraud risks

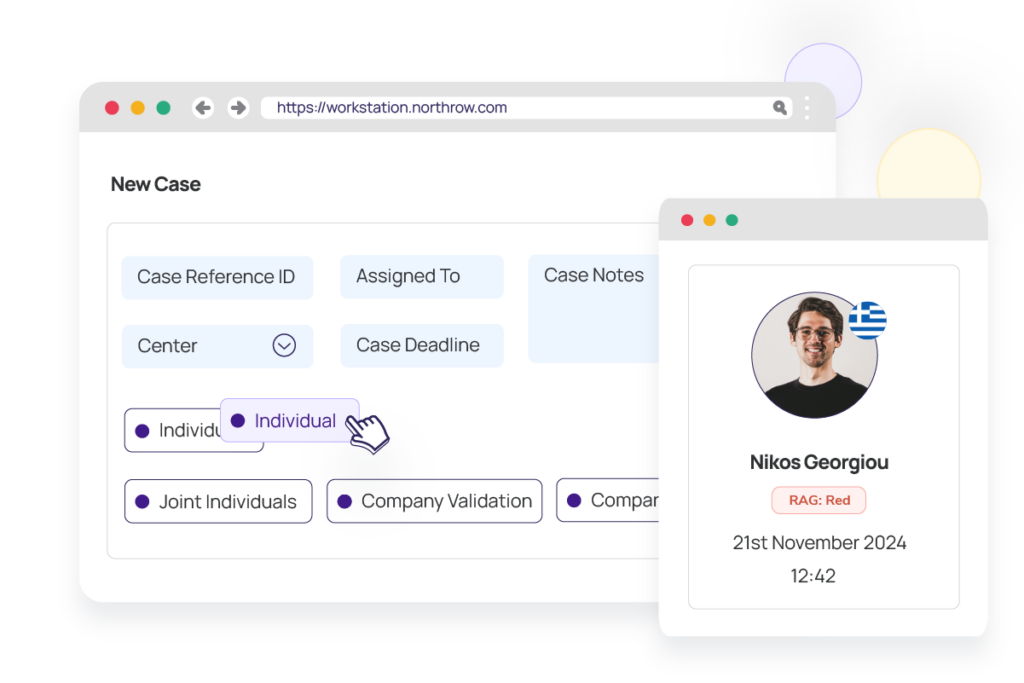

Streamline fast, accurate, and cost-effective verification checks to onboard tenants and businesses, ensuring AML compliance and minimising risks for property management firms.

Request Demo

👋 Hi, let’s schedule your demo.

Tell us a bit about yourself.

“

The system efficiently and effectively completes our KYC and KYB verification requirements during onboarding.

Robin Kear

Senior Account Executive