In this article, we take a look at some of the key strategies and tactics to ensure the fine balance between the need for in-depth scrutiny of PEPs for AML compliance and the delivery of an exceptional customer experience. … Read More

PEPs

Conducting PEP checks: tools and techniques

In this article, we will explore some of the tools and techniques that compliance professionals can use to carry out PEP checks. … Read More

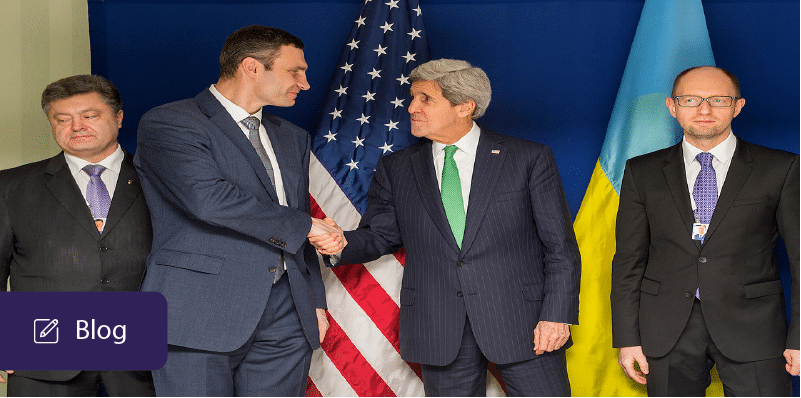

Working with Politically Exposed Persons (PEPs)

A Politically Exposed Person (PEP) is an individual who may have been entrusted with a high-position by a community institution, an international body or state, within the last 12 months. … Read More

What is a PEP & should you work with them?

In the world of finance, the term “PEP” holds a significant weight. But what exactly is a Politically Exposed Person (PEP), and why should you be concerned about working with them? PEPs are high-ranking public officials who are vulnerable to … Read More

Why are PEPs high-risk, or are they not all that bad?

In the regulation of financial services, a politically exposed person (commonly known as a PEP) is one who has been appointed to a prominent public function. These individuals may have been entrusted with a high-position by a community institution, an international body or state, within the last 12 months. … Read More

What Are the 7 Biggest Mistakes Firms Are Making When it Comes to PEPs & Sanctions?

There is still a great deal of confusion surrounding the client due diligence process.One area that causes the greatest confusion relates to the 4MLD approach to Politically Exposed Persons (PEPs) and Sanctions checks on individuals and entities. The following represent 7 main misconceptions relating to PEPS and Sanctions Compliance. … Read More

Politically Exposed Person (PEP) | Low vs. high-risk

NorthRow has a ‘PEP Tiering Guidance’ system that can serve as a framework for its to follow due diligence investigations. In accordance with a risk-based approach, the categories are divided into 4 different priority levels please see below the diagram. … Read More

Why Do Businesses Need to Do KYC AML Checks?

To build a strong and robust fraud-prevention system, companies need to incorporate effective anti-money laundering measures into their business processes. To do this, every company needs to know the process of how and when it should do AML and KYC checks. NorthRow works with organisations across multiple sector helping them to automated AML, KYC and IDV checks to streamline client onboarding, while helping to ensure compliance. … Read More