Ongoing monitoring software

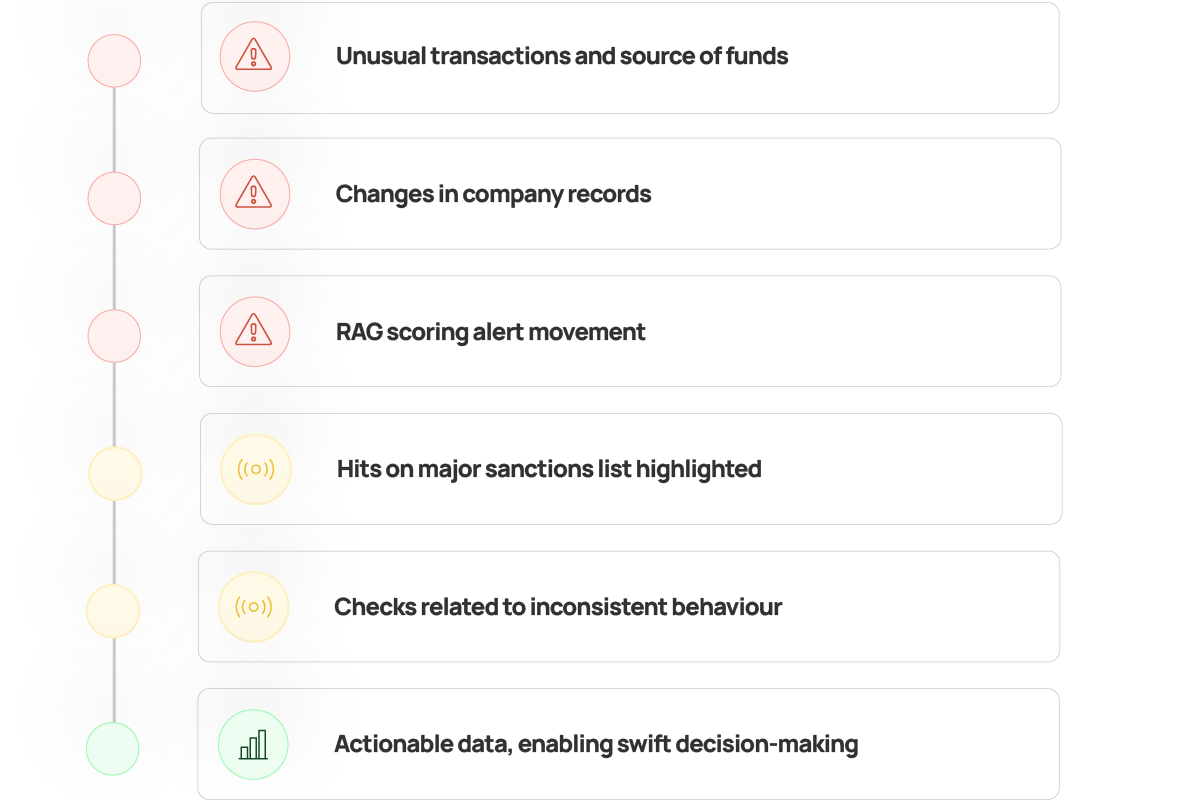

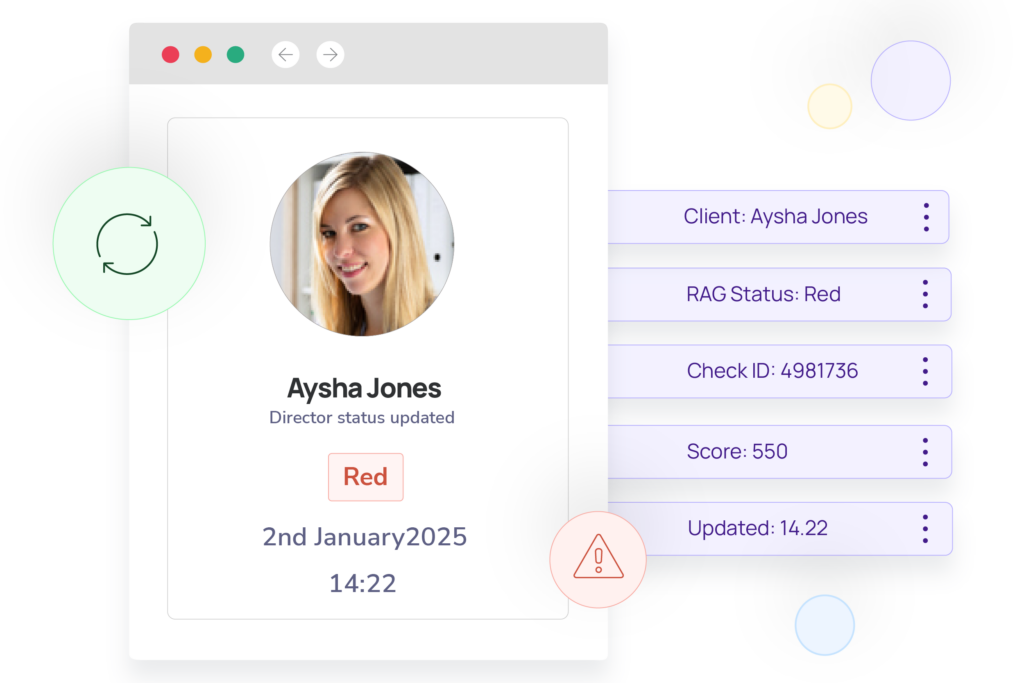

Proactively monitor client risk profiles in real-time.

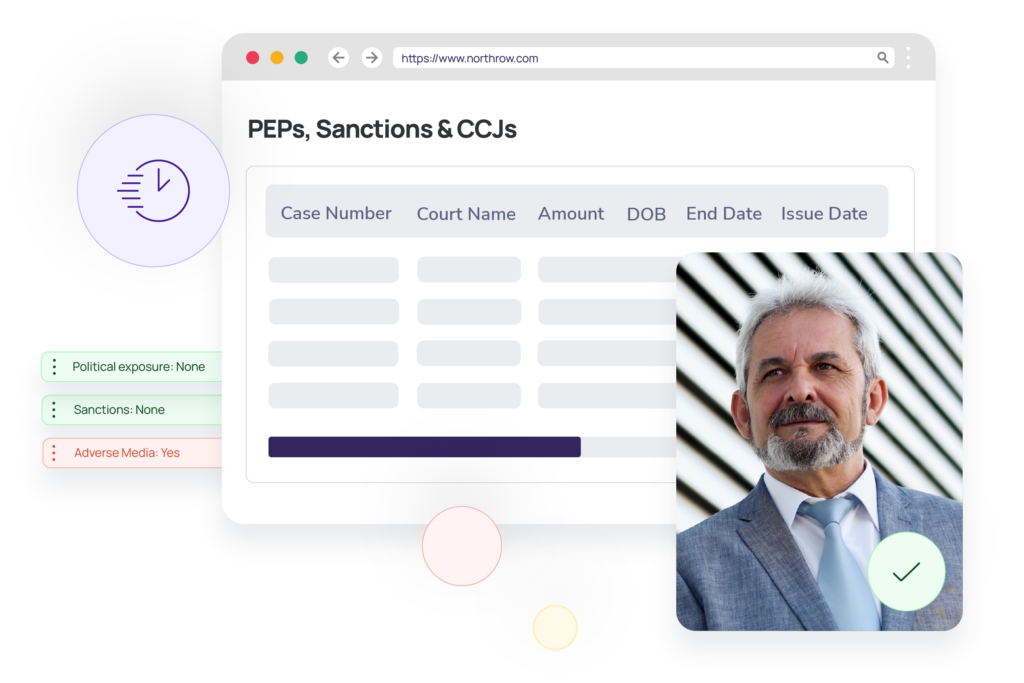

Automatically search, screen, and monitor your clients against global watchlists. With real-time alerts of any risk profile changes to both companies and individuals, you can keep tabs on political exposure, sanctions or adverse media hits to ensure you remain compliant with minimal manual input.

Request Demo

Hi 👋 let’s schedule your demo.

Tell us a bit about yourself.

“

The system efficiently and effectively completes our KYC and KYB verification requirements during onboarding.

Robin Kear

Senior Account Executive