In today’s fast-paced business environment, HR and hiring managers increasingly rely on technology to streamline their processes and improve overall efficiency. With digital right to work software, the entire recruitment and onboarding process can be dramatically improved, meaning your employees … Read More

IDV

What are the Consequences of Inadequate Right to Work Checks?

Every UK employer has a legal obligation to carry out Right to Work checks on prospective employees to prevent illegal working in the UK. Guidance issued by the Home Office expects employers to carefully and systematically verify each employee’s identity … Read More

Why Should you Automate Identity and Verification for Customer Onboarding?

ID verification is a non-negotiable element when onboarding new customers. It’s an essential part of the Know Your Business (KYB), Know Your Customer (KYC) and Anti-Money Laundering (AML) requirements. When done well, it supports the business in creating long-term customer … Read More

Compliance Cost of Amber Management

A world of binary results of either pass or fail, (Green or Red) would be nirvana; but that just isn’t realistic. There will always be cases that require further due diligence before you safely commit to onboard, or continue to interact with the customer, or not. Ambers are those cases that fall between the ‘accept’ or ‘decline and cause your business a challenge. … Read More

Building Societies Digital Transformation

Digital transformation projects have been fast-tracked for Building Societies Learn more now. … Read More

Why is ultimate beneficial ownership verification important?

Ultimate Beneficial ownership verification and ongoing monitoring is now an essential component of the KYC onboarding and anti-financial crime procedures. However, peeling back the complex legal structures designed to conceal Ultimate Beneficial Ownership (UBO) represents a significant challenge. In this blog, we explore the confusion over multiple beneficial ownerships, the complexity share structures, understanding Trusts and how you minimise risk exposure when onboarding and monitoring UBOs. … Read More

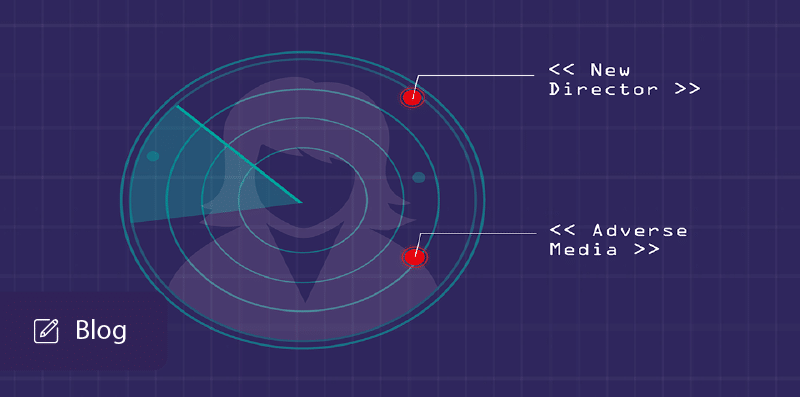

Beneficial Ownership Monitoring is Fundamental for Global Economic Recovery

How well do you know your customer? As the pandemic continues on a global level, your clients’ risk status is changing at unparalleled speed. Effective ‘continuous KYC monitoring’ is essential for Compliance Officers if they want to stay ahead of the criminals. In 2020 firms have made significant investments in digitally transforming the front end of compliance at the point of onboarding, however many firms have not digitally transformed their monitoring processes, exposing their business to increasing levels of risk. In this blog we explore ongoing monitoring further. … Read More

Ongoing KYC Monitoring

Effective ‘continuous KYC monitoring’ is essential for Compliance Officers if they want to stay ahead of the criminals and satisfy the regulators. During 2020 many firms expedited the digital transformation of the front end of compliance, at the point of onboarding, due to the global pandemic and the need to meet the demand for digital interactions. These investments should now be used across the entire customer lifecycle to avoid exposing their business to increasing levels of risk. In this blog we explore the importance of ongoing monitoring in 2021. … Read More

Automated Client Onboarding

Efficient and ‘friction-free’ client onboarding is the key to customer engagement for any regulated business, but the need to balance this against the demands of the regulators is critical. … Read More

Configurable Risk-Based Regulatory Rules Engine

The ever-evolving regulatory landscape in which firms operate in means client risk management is becoming more complex and time-consuming, ultimately impinging on the overall customer experience. To simplify the complexity of KYC onboarding and monitoring an agile risk-based rules engine is the answer.

In this blog, we discuss why a highly configurable rules engine is critical to the customer experience, operational efficiency and future-proofing of your compliance processes. … Read More